The Swiss group was inspired by the experience of founder and CEO Mathieu Aste, who worked in the ingredient industry across functions and regions for 20 years. “Listening to customers anywhere in the world, you realise the food industry is crying for agility and productivity,” he explained.

However, the flavour industry’s current business model struggles to deliver it, Aste suggested. Under the current industry model, flavours are “black boxes” because “there is no specification of flavours most important attribute, their taste". iSense wants to change that.

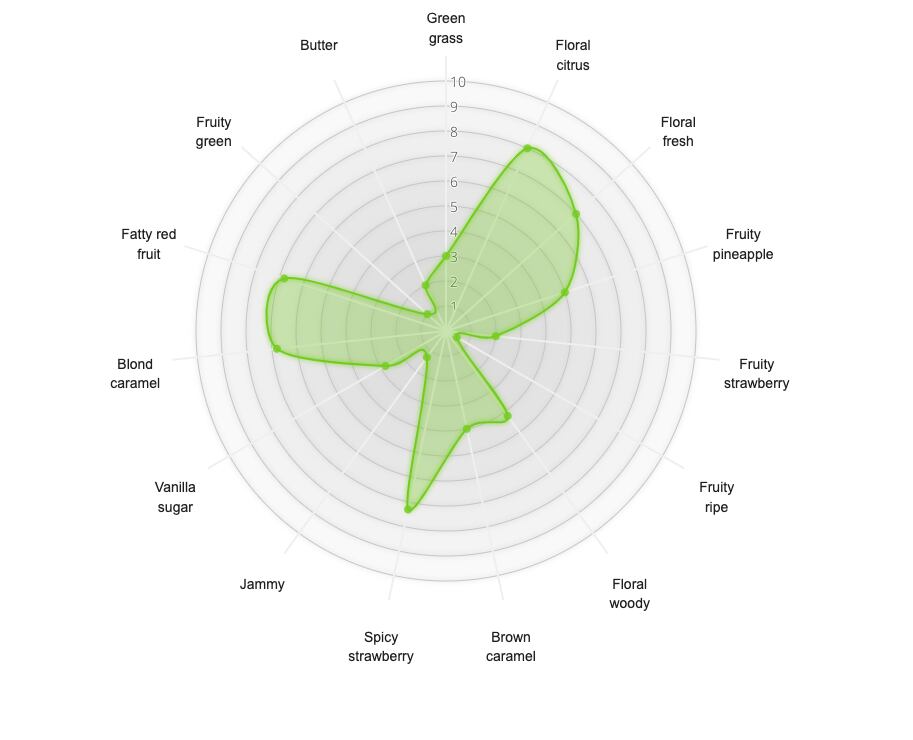

“iSense is a sensory panel operation dedicated to flavours: it delivers a unique sensory profile for individual flavours. We call it digitising a flavour. It brings comparability and discrimination and opens the flavour black box to the benefit of flavour houses and the food and beverage makers.”

iSense has just closed a seed investment round that will fuel its growth plans.

“We’re launching iSense flavour digitization service coming June 2019 for strawberry. It will enable to optimise, benchmark, search and promote strawberry flavours collections. Other flavour types will follow as we gain commercial traction,” Aste revealed.

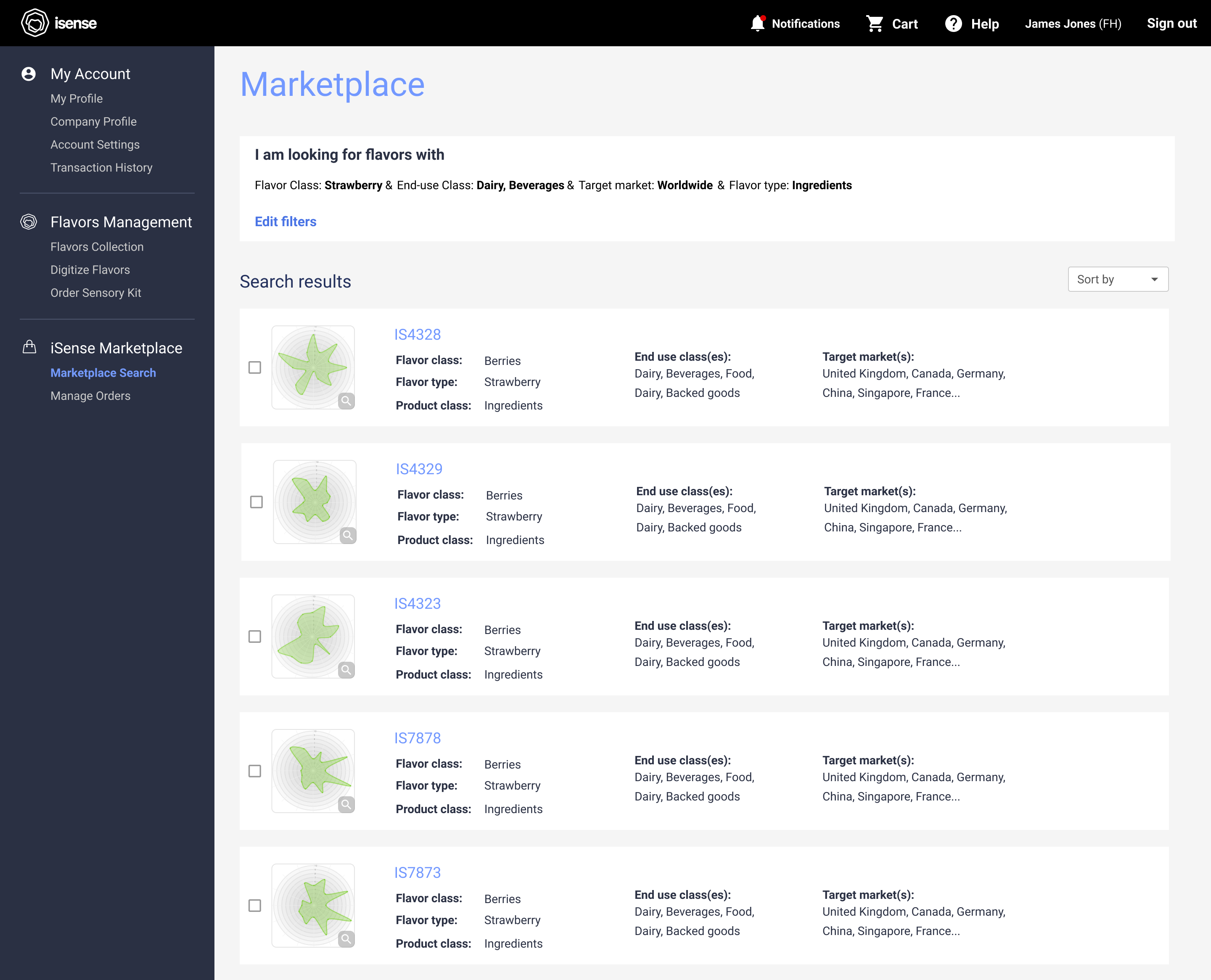

iSense also proposes digital tools with an online flavour collection manager and a market place, both powered by a flavour search engine.

These tools will allow flavour houses to offer “superior value” to the F&B industry, generate productivity and increase their commercial reach. Meanwhile, food and beverage manufacturers will make be able to make a “quicker and sharper choice of flavours” based on data, ordering samples online from a large pool of differentiated suppliers. In this way, iSense believes users will generate productivity and unlock quicker innovation.

‘It has never been done before’

While ingredient makers and food manufacturers have stepped up their investment in digital tools and machine learning – as evidenced by the recent collaboration between McCormick and IBM – Aste told FoodNavigator that iSense’s proposition is unique to the flavours industry.

While investment is increasing, the food industry lags other sectors in the adoption of digital tools, machine learning and artificial intelligence, Aste observed. He suggested there are a couple of factors underpinning this.

Firstly, to generate taste intelligence, you need taste data. The best data to date is delivered by trained sensory panels, which requires time and money. This means that the initial development costs are substantial. An independent sensory operation like iSense enables accurate and objective sensory profiling of flavours, delivered within weeks instead of months, and at a fraction of the usual cost, Aste claimed.

Secondly, food is also an unconsolidated business and only a few large players – the likes of Nestlé – would have the resources to generate meaningful taste data and develop taste models, Aste noted.

Finally, there is no global language of reference for flavour taste, like Pantone is for colours. iSense’s transparent language and language toolkits will facilitate communication: iSense strawberry language toolkit is the key to understand iSense strawberry flavour profiles.

This is a significant change for application managers, sales people, product developers, procurement and marketing. In effect, all players along the value chain can speak the same taste language.

Aste concluded: “iSense’s proposition could therefore have profound implications for the flavour industry’s business model.”

Will iSense drive commoditisation in the flavour industry?

“This is a fear expressed by some of our contacts although most recognise they [already] invest resources on flavour matching for a dubious return. They realise the need to refocus their best resources on innovation”. And this is what iSense aims to achieve: connecting efficiently the flavour houses with the F&B makers to refocus resources towards innovation.

A ‘great opportunity’ to disrupt the flavours market

Early on, iSense decided to concentrate its efforts on flavours rather than ingredients such as functional ingredients, texturisers or bulk commodities. Aste said this is because the ingredients market is already controlled by a few big suppliers and ingredients mostly have a specification for their functionality. They can be compared and discriminated. And multinational suppliers like Ingredion are already developing their own platforms to connect digitally with mid-sized food makers.

In contrast, the digital innovator told this publication, in flavours, the offer is “atomized between many small and local suppliers.”

He continued: “Sure five flavour houses control over 60% of the flavour market, but there is still a queue of 1000 others, and even more if you count all the flavour ingredient suppliers. And taste is local which gives an edge to regional and local actors well connected to their market.”

Currently, because the functionality of a flavour - its taste - is not specified, and because there is little innovation, the main differentiator between flavour suppliers is access to market, Aste believes. Here, the large flavour houses have a clear advantage.

“iSense brings comparability and access to market. It alters the balance of power: flavour houses are playing on a levelled out competitive field that is about the product “Flavors”, not their marketing or ability to access markets. Food and beverage manufacturers suddenly can search flavours at a click, benchmark their collection, and consider different sourcing options.

“Small to medium size outsiders will thrive when they embrace digital to access markets: their products will be visible to more customers with a targeted offer channelled through iSense marketplace.”

And while the iSense marketplace could heighten competition for the large players, Aste said there is also a sound commercial argument for them to participate: productivity.

Leveraging existing large collections of flavours quicker, rather than creating new flavours, is something iSense users look at. “For flavour houses, the main source of productivity will be through the leverage of existing flavour collections across broader geographies, instead of creating new flavours. Application technologists will be able to make recommendations based on data, tapping into an existing wealth of flavour formulations. And flavour creation will change with the emergence of predictive models,” he predicted.

Changing the way flavours are sourced

As well as opening up competition in the flavours market, iSense’s model carries a number of benefits for food and beverage makers. “Everything that creates productivity, sustainability or ease innovation along the value chain is relevant,” Aste explained.

“F&B manufacturers will have a new way to source, search, select and formulate with flavours. iSense data can yield to food taste predictive models that will support accurate and immediate choices of flavours. It has the potential to cut flavour selection time significantly for each new product development,” he predicted.

“Ultimately, our ambition is that iSense becomes the frame of reference for flavour taste. It will make the interface between flavour houses and F&B manufacturers more efficient. Flavour houses embracing iSense will offer superior value to their customers and thrive.”

iSense started its panel operation with its partner Eurofins SAM. Digitization of strawberry and vanilla flavours will be available from June 2019, while iSense’s online collection manager and market place will be launched during the summer.

“Based on the market response, we’ll expand operations geographically from Q4 2019,” Aste added.