Lumina Intelligence investigated how the food and drink industry is responding to the UN's Sustainable Development Goals (SDGs).

Its 'Food & Drink Sustainability 2019 - Global Progress Report' analysed more than 900 commitments made by some of the largest players in food and drink through corporate social responsibility (CSR) reports and media releases.

The analysis featured pledges by manufacturers such as Nestlé, suppliers such as Cargill, food service operators like Starbucks and retailers such as Walmart and Amazon.

“We wanted to use the data to see how well aligned the food and drink industry is to the UN’s sustainable development goals,” Oliver Nieburg, Lumina market analyst told FoodNavigator.

“We wanted to see if there’s any substance to the claims they're making and see how far they go to achieving impact.”

The report found that food and drink companies are embracing sustainability as a core business philosophy, evidenced by $5.2bn (€4.5bn) pledged towards sustainability up to 2050.

But more clear cut action is needed, it said, with measurable commitments such as ensuring 100% sustainable agricultural volumes to recognised definitions by 2030.

“There is a lot of money being spent and due to be spent on sustainability but we’re not necessarily any closer to knowing if it’s going to do any good,” according to Nieburg.

The impact of sustainability projects needs to be better assessed

Very few companies ensure the programmes they set up to address SDGs are actually effective, complained Nieburg, who says more due diligence is needed.

“The programmes that they are implementing and the commitments that we see from a lot of these companies are almost purely on the method to achieve things.”

In an effort to address poverty in sub-Saharan Africa, for example, a company may commit to train 100,000 farmers or provide a million seedlings.

“But very few companies are actually measuring the final outcome to see it’s making a difference to the pockets of farmers,” said Nieburg.

There are exceptions, though. Barry Callebaut is committed to lifting 500,000 cocoa farmers above the extreme poverty line by 2025. Mondelez is committed to reporting the net income of cocoa farmers within their programme.

But more companies should take a closer look at these target indicators, Nieburg said.

“No one is saying that these companies are responsible for global poverty, but at least they can measure the impact, and very few companies are doing that.”

Another example is the effectiveness of third-party certification, which is the number one goal that attracts commitment among food companies.

“There’s been some analysis which suggests that it’s helpful in boosting farmer yields but potential limited effect on things such as food security, income and curbing deforestation,” said Nieburg.

Are food companies truly committed to tackling sustainability?

Without better data, firms could be open to criticism they are not taking the issue seriously enough.

Companies are having to be committed to sustainability projects as they find themselves under external pressure from governments and to appease investors to show they are doing their part.

“You see in the language companies are using that they are committed,” said Nieburg. “But if you look closely at the data there’s one school of thought that would say that a lot of the commitments go to securing the supply of a commodity at a low cost… there are very few measurements into what the UN is looking at, which is the human and environmental dimensions.”

The importance of traceability technology

Food companies need to keep investing heavily in traceability technology – particularly mobile mapping technology – to ensure that their commitments to sustainability global programmes are effective, continued Nieburg.

“Hopefully some industry trade bodies or governments could provide guidance on collecting this data and what should be reported because otherwise you may end up with just varying collection methods and standards and a lot of data, none of which can be really compared to assess impact.”

What about consumer demand for sustainable products?

Consumer demand is also a problem, according to Lumina, which has looked at how consumers are responding to sustainable products. It collected data across 20 counties on around 3,000 chocolate, coffee and tea products.

“What we saw is that roughly a quarter of products are making sustainable claims in some form either on pack or in product descriptions on retailers or manufacturers product websites, but the online engagement was not necessarily any higher for products making sustainable claims,” said Nieburg, with both the number of reviews and star rankings online lower for these products.

“So there’s some evidence to suggest that while there’s the perception consumers are becoming more ethically conscious and socially aware, we not seeing that in terms of engagement with the sustainable products.”

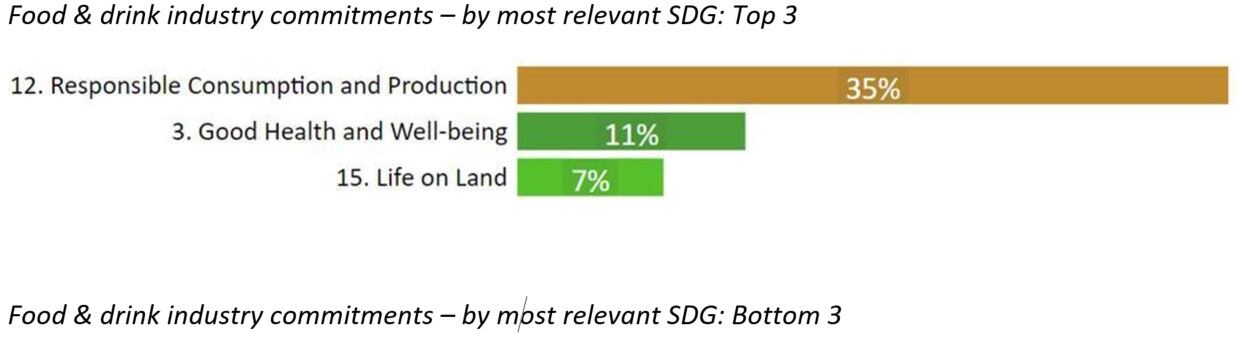

Lumina assessed industry alignment with the SDGs by comparing time-dependent commitments from companies against the UN’s SDG indicators, corporate reporting guidelines and advice on business reporting.

Other key findings from the report include:

- The 34 analysed food & drink companies address environmental, social and economic aspects of sustainability with 905 pledges and $26.3bn assured for the UN’s 17 SDGs up to 2050.

- The food and drink industry’s pledges are aimed at supporting 14.9m farmers and 568m people.

- Companies have set aside $2bn for pledges focusing exclusively on cocoa and $1.2bn for pledges aimed at coffee. These sums exclude coffee and cocoa investments as part of multi-crop commitments.