During the summer, USMEF technical services manager Cheyenne McEndaffer and Monty Brown, USMEF representative in Europe and Africa, visited South Africa to examine export opportunities for US beef and pork, assess the competitive landscape of the South African market and identify and address market access barriers for US products.

They explained that some US products – especially beef livers – had gained considerable traction in the market, but noted there were “ample opportunities” for further growth if regulatory obstacles could be reduced or eliminated.

“Not long after the market opened, South Africa quickly jumped to our second-largest beef liver market,” said McEndaffer. “It’s still small compared to our top liver importer, Egypt, but USMEF is always looking for ways to diversify markets for variety meat and there is a lot of demand in South Africa for offal items, including livers, tripe and kidneys.”

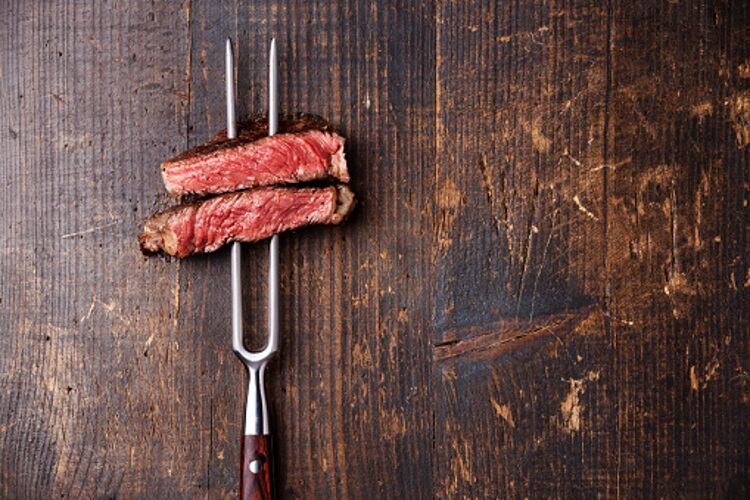

McEndaffer added that US beef muscle cuts were also achieving some success in South Africa.

“South Africans love meat and they especially love high-quality meat on the bone,” she said. “South Africa is a big domestic beef producer and they slaughter very young, so the product is very tender and lean. But it doesn’t have the marbling that US beef does, so we see opportunities for US middle meats in high-end steakhouses. These cuts have already established a presence in the major city centres’ restaurant sector, but we’re also looking at opportunities for items such as short ribs. Beef trimmings also have potential for use in South Africa’s large meat processing sector.”

According to USMEF, in the first half of 2018, beef and beef variety meat exports to South Africa totalled 7,804 metric tons (mt), down slightly from the same period last year. However, thanks to beef muscle cuts increasing significantly (1,261 mt, up 1,026%) from last year’s low volume, export value to South Africa increased more than 40% to US$8.6m. South Africa’s total imports were about 36,000 mt, meaning US beef accounted for 22% of South Africa’s import volume, which is second to Australia (24%). Remaining market share is mostly divided among Namibia, Botswana, the European Union, New Zealand and Argentina.

Barriers to entry

Exporting pork to South Africa has proven challenging to the US due to technical restrictions.

“We still face some technical difficulties on the pork side from animal health-related restrictions on what we can or cannot send,” said McEndaffer. “We do see a lot of buyer interest for pork offal, but unfortunately the US does not have access for offal items. So USMEF is working with other trade associations to see if we can expand the range of eligible products. There is also still some confusion among US exporters as to which cuts are eligible for retail and which must go directly for further processing, and some are concerned about products being rejected or delayed.”

McEndaffer and Brown met with officials from South Africa’s Department of Agriculture, Forestry and Fisheries (DAFF) to discuss issues that may be inhibiting US red meat exports due to lack of clarity about product and plant eligibility, documentation requirements or export/import procedures.

Microbiological testing was identified as a big factor for importers clearing product at South African ports. The frequency of testing varies greatly between ports, as does the corrective actions requested.

Packaging issue

Packaging is deemed a contentious issue in South Africa, as many containers are stopped at the port of entry due to packaging that is deemed “inferior”.

“The magic words in South Africa seem to be ‘wrapped and packaged,’ which is terminology widely used in the European Union,” said Brown. “We are seeing stepped-up enforcement when pallets of product have insufficient external wrapping to prevent contamination. Local importers are resorting to poly blocks wrapped in a large plastic sheet, or bags placed inside cardboard jumble bins, in order to overcome this problem.”