Consumer demand for alternative and plant-based sources of protein is on the rise in Europe. The growing trend among millennials in particular to adopt flexitarian and meat-free diets signals a significant shift in generational purchasing habits.

The utilisation of seaweed as a source of nutrition is still in its infancy in the region, but it is gaining increasing attention as consumers seek out new sources of protein and other nutrients.

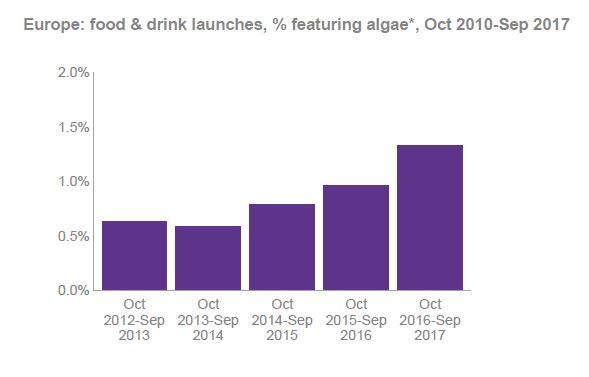

Data from Mintel shows that product launches containing seaweed and algae have doubled between 2015 and 2017, to total 1.4% of new product launches.

Mintel analyst Julia Buech noted that spirulina – a microalgae often used as a natural food colour - accounted for almost two-thirds of launches. However, she added that other varieties of seaweed are “starting to play a more prominent role” as a “key ingredient” in food and beverage applications.

Israeli-based Algatechnologies, which produces microalgae for distribution in 35 countries around the world, said that currently the vast majority of its production – around 90% - is used as an ingredient in the supplements sector. But Efrat Kat, VP of sales and marketing, did note an increase in interest from food and beverage manufacturers.

“Microalgae is the story of the twenty-first century. It is an untapped source of so many ingredients and nutrients,” Kat suggested. “We are seeing more demand from big companies in food and beverage. Once the awareness grows and there are the right delivery methods we expect demand growth [to accelerate].”

The UN estimates that by 2050 global meat supplies would need to increase by 50% if current demand levels continue in order to meet the needs of the growing population. Currently, 26% the Planet's ice-free land is used for livestock grazing and 33% of croplands are used for livestock feed production. Around one-seventh of all greenhouse gas emissions now come from meat production alone.

Seaweed’s sustainability story

Increased consumption of plant-based products is supported by concerns over the environmental sustainability of the food system as it stands today.

Proponents of seaweed consumption claim that seaweed’s sustainability story goes some way beyond land-based plant-protein production.

“We will need another four planets by 2050 if we don’t look at new sources of protein,” Angela Ferrato, who works in business development at seaweed manufacturer Seamore told FoodNavigator. “The ocean covers 71% of the planet and now we only get 2% of food from the ocean… We should shift from sourcing food from the land to the ocean.”

For Ferrato seaweed is an obvious answer. “Our diets are too focused on animal protein. If you connect the ocean and plants you get seaweed. It is the food of the future.”

Andrew Dahl, CEO of Zivo Bioscience, also highlighted the sustainability credentials of algae production compared to the production of other plant-based proteins.

“There is a tremendous sustainability story,” he told FoodNavigator. “Compared to soy and other plant-based proteins, we get five times the amount of protein from the same area [of land]. We use 10% of the water and 10% of the fossil fuel for an equivalent amount of protein…. We sequester 2 lbs of carbon to create 1 lb of algal biomas and 1 lb of oxygen.”

Seaweed’s positive nutritional profile

Seakura owner Yossi Karta echoed the environmental arguments for the increased adoption of seaweed in the diet and stressed the positive nutritional profile of oceanic plant life.

“The idea to grow seaweed came to me because this is the first brick in the food chain,” the owner of the Israeli seaweed company explained. “I thought, if seaweed is the beginning it must have all the things people need.”

While content varies between species, seaweed features a high protein and mineral content, including iodine, magnesium, calcium, riboflavin, folate, iron and potassium. It is a good source of vitamins A, C, E and K and is typically rich in fibre and polyunsaturated fatty acids (omega-3 and omega-6).

On the negative side, seaweed can be very high in sodium. Plants that are taken directly from the sea also face a risk of picking up any pollutants they come into contact with, Seakura’s Karta explained.

'Tech and know-how': the key to quality production

Seakura has developed a proprietary filtration technology that allows it to overcome this hurdle. “Seaweed is the filter of the sea, it absorbs and accumulates. It has a membrane that takes in but does not put out pollutants,” he noted.

The company, which supplies frozen seaweed to Whole Foods in the UK among others, pumps seawater into a tank where the group’s unique filtration system removes heavy metals and other pollutants. It plans to license out this technology to partners worldwide.

Seamore, which uses wild seaweed sourced directly from the ocean, takes a different approach. The group’s organic seaweed is harvested in Europe and Seamore relies on independent lab analysis to check for heavy metals and other pollutants. “We are getting more active with farming to build scale,” Ferrato noted.

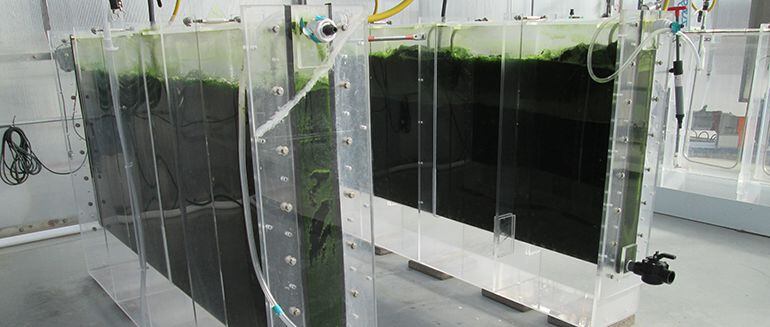

In the production of microalgae, both Zivo and Algatechnologies use closed loop systems.

US-based Zivo is developing a pilot production plant in Asturias, Spain, which it expects to have registered with ESFA in around a year. The group also has production in India, China, Taiwan and is in discussions with a potential partner in Peru. Zivo currently supplies its ingredient for use in animal feed and human food in the form of dietary supplements and specialized protein products. But Dahl anticipates expanding this: "As we expand our production capacity we will be able to supply mainstream food products," he predicted.

Algatechnologies cultivates astaxanthin microalgae from the arava strain, known for its antioxidant properties. The group operates 600 kilometres of pipework at its solar-powered facility near Ketura, Israel. "Three parameters affect the quality of the product: strain, technology and environment," Kat said. "Growing algae on a large scale requires technology and know-how. We are writing our own book. The know-how we have developed is very unique."

Making it an ‘everyday option’ in Europe

Seakura's frozen seaweed 'drops' are sold with recipe cards that aim to show consumers the different possible uses for seaweed.

"People don't understand what to do with it. One of our biggest challenges is to educate the market."

Despite the positive story around nutrition and sustainability, seaweed is not a common component of the European diet.

In order to make products more accessible, Seamore - which currently produces dried seaweed products - is focusing on developing “gateway” items like tortilla wraps and baked goods via its new technology to develop what the company describes as “seawheat”.

“This will enable us to create new products with increased seaweed content,” Ferrato explained. “After bread, we tested nachos with 50% seaweed content. We are now having some fun with ice cream but our main focus is on bakery.”

In this way, Seamore hopes to extend the appeal of seaweed products beyond functional consumers to what Ferrato terms “lifestyle” and “mainstream” consumers. “I see a lot of acceptance from people,” she observed.

US-based Zivo believes that it’s proprietary strain of microalgae will enable food manufacturers to extend the applications that this protein can be used in.

“The biggest problem with algae is the taste and smell,” Dahl explained. “Most strains have a very strong odour and are not necessarily palatable… Our algae has a very neutral odour and little taste. It is more like broccoli than anything that comes out of the sea. It accepts flavours easily and is shelf stable.”

Meanwhile, Algatechnologies is working to develop different ingredient options to expand its offer to food manufacturers. “Many companies are looking for new delivery forms,” Kat revealed. “We are investing in all different solutions… We can offer it as an emulsion, water soluble powder, beads for tablets… Through our proprietary [extended shelf life] ESL tech we can keep all the natural components in the algae undamaged, keep it as it is in nature, but break up the membrane so it is easily digestible.”

For seaweed foodstuffs to increase their uptake in Europe, this type of ingredients innovation, research and product development will be key as the industry works to add seaweed to more food and beverage products, making this superfood more accessible to mainstream consumers.