Worth £2.2 billion (€2.47bn) in 2017, the British organic sector is continuing its trajectory of six years of solid growth with food and drink sales hitting record levels, said a report published today by certifying authority, the Soil Association.

Dairy has the biggest market share with 28.7% certified organic, according to Nielsen Scantrack data while fresh fruit and vegetables have nearly one quarter (24%) and meat, fish and poultry 10.2%. All three categories are showing year-on-year growth.

Using feedback from a survey carried out on a small number of 10 - 55-year-olds, the Soil Association identified six key trends that it says are influencing what people eat today. According to business development director at Soil Association Clare McDermott, organic “definitely” fits into all six:

Healthiness: Consumers want products that are natural and less processed foods, give energy or sustenance and meet specific dietary needs, such as free-from foods.

Taste and inspiration: The quality of a product as being central to how good it tastes.

Fits around me: Consumers’ lives are busy and hectic. Shopping and making food is time consuming and so consumers try to achieve a balance between price, quantity, quality, time to prepare and tastes everyone will love.

Pleasure: Most consumers allow themselves some products that are more special, indulgent, a ‘treat’, or that deliver more flavour.

Value: Value is a personal ‘equation’ consisting of price, quality and convenience, and the importance of each factor varies - sometimes even for the same individual. For example, he or she might buy organic vegetables but non-organic meat.

Making a statement: Consumers often buy products because the food and/or packaging look beautiful. This increases their appetite or gives them something to talk to their friends about.

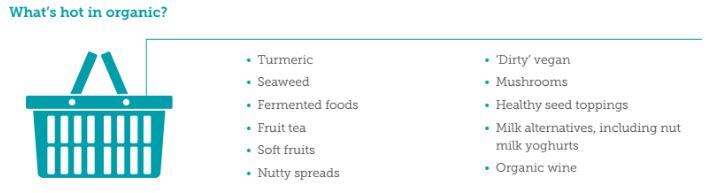

The research also showed five growing outside influences on what food people buy, which are British provenance; meat reduction and vegetarianism; milk alternatives; concerns about food production and the Instagram culture.

Channeling further growth

McDermott told FoodNavigator: “Organic is well placed to help answer the six key beliefs and, in particular, organic is clearly becoming a signpost to health. It is much more readily available and can be bought everywhere on the high street, from discounters to multiples to the fast growing online sector which is offering consumers huge choice in organic products. As we at the Soil Association work to make the organic message clearer, this helps people see the value in buying organic."

McDermott said that brands could leverage the fact that conumers are “taken aback” when they realise the level of assurance organic provides in terms of standards.

"Brands can make more of organic messaging to further this understanding and of the 'food as it should be' message to explain organic simply and clearly to consumers," she added.

A growing space: Acquisitions & new lines

Packaged goods and processed foods are also growing in importance, and 'Big Food' is taking note.

In recent years, a number of big multinationals have been expanding their organic portfolios such as Coca-Cola launching its Honest T brand and Kellogg’s bringing out an organic cereal brand. “[This] is exciting and is driving innovation in the UK market”, said the report.

Strategic acquisitions of niche, independent brands is another way big manufacturers are entering the space - Unilever bought Pukka Herbs last year, for instance – which also allows quick scale-up opportunities for those small brands.

“This [Pukka] purchase, and other launches from Coca-Cola, Kellogg’s and Arla, send a strong signal that global FMCG businesses see a positive, healthy future in organic food and drink.”

Traditional retailers losing out

The UK’s two biggest supermarkets, Tesco and Sainsbury’s, along with high-end retailer Waitrose dominate supermarket sales of organic products (including non-food), accounting for around 70% of the total. However, independent retailers and home delivery sales are outpacing supermarket growth.

What’s more, big supermarkets have still not taken advantage of the opportunity to sell more organic products online by extending their online ranges, instead selling the same products online that are available in store. This has created an attractive gap for specialist online operators such as Ocado and Amazon, according to the certifying body.

“Online works for organic,” it said. "Online operators make unique brands widely available to consumers while offering the convenience of shopping for routine longer life grocery and non-food items,” the report said.

“Online operators also offer a unique springboard for testing new organic brands. They can be an incubator for them, helping them to understand the pattern for consumer demand before they extend distribution.”

Silver linings: Food safety and transparency concerns

Concerns over the uncertainty of Brexit, as well as media reports on the possibility of US-approved chlorinated chicken and genetically modified ingredients, entering the UK market may also incite individuals to buy more organic.

Any consumer mistrust in the food industry and supply chain generally bodes well for organic, the Soil Association said, which is known for its stricter stance on animal welfare, biodiversity and independent checks and controls.

Last year saw traces of the “moderately toxic” (according to the World Health Organisation) insecticide Fipronil in eggs and the continuation of fake farm brand names used to market produce as being more ‘wholesome.

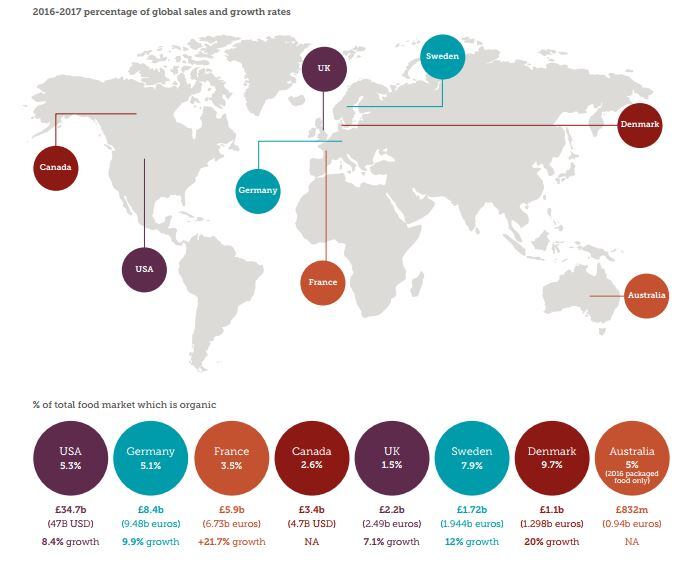

Organic around the world