Industry trade body the Food and Drink Federation (FDF) argues promotions help make food more affordable and opposes any taxes demonizing certain product categories.

Share bags on offer

UK government policy

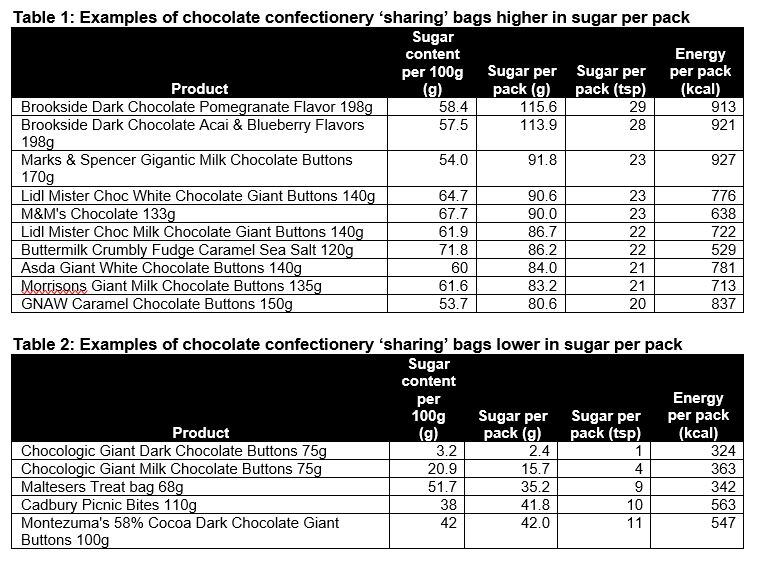

Confectionery escaped a UK tax on sugary drinks introduced in 2016. However, UK government body Public Health England (PHE) last year issued voluntary health guidelines on portion sizes and sugar content in nine food categories, including confectionery. PHE recommended chocolate should contain a maximum of 43.7 g of sugar per 100 g by 2020.

Action on Sugar – formed in 2014 by academics behind the Consensus Action on Salt and Health (CASH) – accused manufacturers of encouraging excessive sugar consumption by discounting confectionery share bags.

It pointed to a survey by our sister publication The Grocer in 2014, which found around a third of 16 to 24 year olds admit to eating a whole share bag alone.

The group said Tesco, Asda, Sainsbury’s, Morrisons, Co-op and Waitrose had price promotions on some sharing bags, sometimes for £1 ($1.43) per bag, between December 2017 and January 2018.

Action on Sugar: An incentive for innovation

Action on Sugar contends confectionery price promotions are contributing to high rates of obesity, type 2 diabetes and tooth decay in the UK.

It called on retailers to “act responsibly and no longer profit at the expense of our health”.

Kawther Hashem, of Action on Sugar, told ConfectioneryNews: “Retail promotions are designed to drive consumption.

“If we ban promotion of confectionery, we can create a strong incentive for both retailers and manufacturers to promote new and innovative products that are lower in sugar and calories – undoubtedly that will help consumers make healthier choices and have a balanced diet.”

FDF response

An FDF spokesperson said: “Research suggests that promotions are already a declining part of the marketing mix for most major UK retailers and HFSS (high fat, salt or sugar) foods do not make up the overwhelming proportion of such promotions.

“Retail promotions not only make food more affordable, they also allow established brands to promote new, innovative products and help challenger brands to get established.”

The NHS Scotland research to which FDF refers says: “While the number of promotions on healthy and unhealthy food and drinks appear to be equal, price promotions on unhealthy foods and drinks tend to offer a greater reduction in price or greater product volume for a set cost than promotions on healthy foods and drink, resulting in the uptake of promotions on unhealthy food and drink being much higher.”

A report by IRI suggests 61.9% of UK confectionery volumes were sold on promotion for the 52 weeks ending November 5, 2016, a decline of 2% on the prior year.

Confectionery's contribution to sugar intake

The UK’s National Diet and Nutrition Survey found chocolate confectionery accounted for 8% and sugar confectionery 6% of average daily non-milk extrinsic sugars (NMES) among children aged 11-18. Only fruit juice (10%) and non-low calorie soft drinks (29%) accounted for more.

UK candy tax

Action on Sugar argues confectionery is the second biggest contributor to sugar intake in children, after soft drinks.

The group has renewed calls - first made in May last year - for the UK’s sugary drinks tax to be extended confectionery with a minimum 20% levy.

Action on Sugar’s Hashem said: “There is evidence that consumers are price-sensitive, so introducing a tax, can reduce excessive purchase.”

FDF’s spokesperson said the trade body opposes food taxes.

“There is no substantive evidence that they make any meaningful difference to obesity.

“Instead of demonising individual nutrients, products or categories we should instead be promoting balanced diets,” they said.

Background reading...

Usual suspects: Confectionery may be next victim of national sugar taxes (22-Mar-2016)

Tax on sugary drinks may be extended after review (28-Apr-2017)