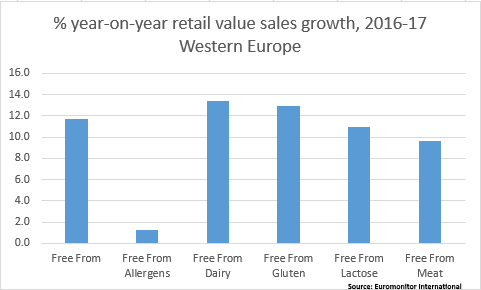

Free-from sales are on the up-and-up in Europe as consumers look to the sector to deliver options that are perceived as ‘better for you’. Sales data from Euromonitor International reveals that total free-from sales increased in both Western and Eastern Europe during 2017, gaining 11.7% and 8.7% respectively.

Traditionally, the manufacturers of free-from food products were meeting the needs of consumers suffering from dietary intolerances. However, demand for free-from foods is evolving in more established markets.

The 2017 data suggests that the majority of sales growth in the developed free-from markets of Western Europe did not come from consumers avoiding certain foods due to medical reasons. Food that is free from allergens showed comparatively sluggish growth last year, with year-on-year sales gains standing at just 1.3% in the region. It is worth noting that allergen-free foods booked a stronger growth rate in Eastern Europe, where the market is less advanced, rising above the average growth rate at 9.2%.

‘Health halo’: an opportunity or threat?

Maria Mascaraque, an analyst with Euromonitor, suggested that in Western Europe the free-from category has extended its appeal to consumers incorporating free-from products into concepts of a ‘healthy lifestyle’.

“I would say that free from is one of the winners within the health and wellness offering along with organics. Both categories recorded the largest growth in the review period at a global level and in particular free from led growth in developed countries,” she observed.

But if the free-from sector is currently the beneficiary of a ‘health halo’, this leaves the sector at risk of falling foul of negative press or swings in public opinion.

Indeed, research from Mintel found that 54% of consumers who currently buy free-from products would stop doing so if they thought they were ‘less healthy’ than standard offerings.

“The health halo of free-from foods is a key driver of uptake and has resulted in a much larger group of users than the limited number of actual or suspected allergy or intolerance sufferers. However, this leaves the free-from food category exposed to changes in consumer opinion and media coverage. The importance of health in driving uptake also means that companies need to ensure that nutrition profiles are best in class,” Mintel’s Kiti Soininen said.

Growth categories: dairy- and gluten-free

The free-from categories that reported the fastest growth rates in 2017 were dairy-free and gluten-free, which rose 13.4% and 12.9% respectively, Euromonitor revealed.

Dairy-free products have grown in popularity at the same time as dairy-based revenues have come under pressure. The dairy sector has been linked to negative associations around its environmental footprint and its health credentials, a situation that has been somewhat compounded by a lack of innovation in the space.

This stands in contrast to plant-based dairy alternatives, where growth is being supported by dynamic product development. Formerly dominated by soy alternatives, the sector has seen other milk alternatives overtake soy in retail sales value. These range from almond and coconut milk alternatives to oat- and rice-based options and other nuts such as cashews or hazelnuts.

Meanwhile, Mascaraque said gluten-free manufacturers proved the “most dynamic” during the review period. The sector was lifted by a general move away from high carb options such as bread, pasta, rice and cereals.

Rising competition

Growing free-from sales are both spurring and supporting higher levels of product development. Mintel figures reveal that 12% of all UK food product launches in 2015 carried a gluten-free claim, more than double 2011’s rate, which stood at 7%.

NPD is necessary to generate consumer excitement and sustain sales growth. In particular, high levels of product development has enabled existing consumers that buy into the free-from concept to expand the range of free-from foods that they buy, Mintel’s Soininen noted.

“The growing availability of free-from food and drink products at mainstream supermarkets has allowed established users to widen their repertoires, with easy availability potentially prompting more regular use,” she suggested.

It has also made the free-from sector more competitive.

Mascaraque described the “huge competition” appearing in the free-from space as an “important challenge” facing manufacturers. As a result, she said, “strong brands” such as Genius and Wessanen-owned Mrs Crimble’s in the UK have re-branded their offerings to “stand out on shelf”.

Innovation will be key to unlocking the further potential of demand for free-from foods.

In order to maintain a reputation for health, manufacturers will have to make progress in areas like sugar or fat reduction.

They are also likely to tap into broader consumer demand for products that are perceived as ‘natural’ as well as demand for convenience.

In the gluten-free category, for example, the inclusion of ancient grains that are naturally gluten-free into on-the-go convenience foods feeds into these key trends, Mascaraque predicted.

“Grains that are naturally gluten free [are] the way forward in this particular category. Naturally gluten-free grains such as amaranth, quinoa, sorghum, buckwheat, millet and teff are very on trend and will be a huge part of new product developments in the coming years, not only including them in bread or breakfast cereals but also in snack bars or other ready to eat foods to meet consumer demand for convenience.”