The FAIRR (Farm Animal Investment Risk & Return) investor network stated aim is to “raise awareness of the material impacts factory farming and poor animal welfare can have on investment portfolios”.

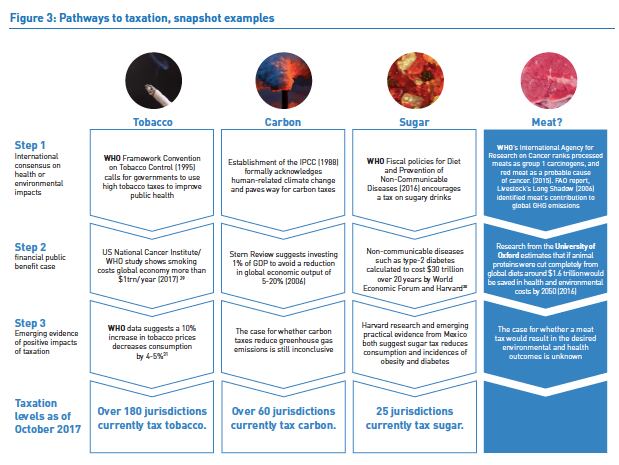

Over 180 countries tax on tobacco, 60 jurisdictions tax carbon and at least 25 tax sugar, and it’s “highly probable” that meat will be next, it says in a white paper entitled The livestock levy: Are regulators considering meat taxes?

“The pathway to taxation typically starts when there is global consensus that an activity or product harms society. This leads to an assessment of their financial costs to the public, which in turn results in support for some form of additional taxation.”

The decision of the World Health Organisation’s cancer research agency IARC to classify processed meat as a carcinogen has echoes in the negative health implications already associated with tobacco and sugar, they write.

Belgium has reshuffled its healthy eating pyramid to move meat in the same space as chocolate and sweets while the UK’s Eatwell Guide recommends plant-based proteins over meat and dairy.

Other countries have given signs of mulling a meat tax – Denmark’s advisory think tank Council of Ethics told the government a meat levy could “make a big difference” to climate change - although none has actually made the move to table a bill.

FAIRR writes: “Although no proposals have advanced into actual legislation, long-term investors should take note of the compelling arguments being made, especially in Denmark and Sweden. It was in the Nordics that the first carbon tax was introduced in 1990.”

Shadow price

The white paper authors are calling on companies to consider adopting an internal ‘shadow price’ of meat to account for future costs, “in the same way many use internal carbon pricing”.

It does not calculate what tax band would be needed to make meaningful reductions in meat intake, but points to proposals in Denmark that suggested a figure of around $2.7 (€2.30) per kilogram of meat.

A Swedish legislative proposal for a climate change tax on food tabled by three Green party MPs suggested around 20SEK (€2) per kilogram.

Dr Marco Springmann, senior researcher on environmental sustainability and public health at the University of Oxford’s Future of Food Oxford Martin Programme said:

“Taxing meat for environmental or health purposes could be a first and important step in addressing these twin challenges [to the environment and health], and it would send a strong signal that dietary change towards more healthy and sustainable plant-based diets is urgently needed to preserve both our health and the environment."

A global consensus?

Head of investor engagements at FAIRR Rosie Wardle said the FAIRR Initiative is not advocating meat taxes but does believe there is a global consensus that over-production and consumption of meat is harming human health, the environment and, therefore, society as a whole.

“We are not suggesting what the level of tax should be, or indeed that there should even be one,” she told FoodNavigator. “What we are saying is that – by looking at previous behavioural or ‘sin’ taxes and looking forward – trend spotting – we are predicting that in the medium to long term future, a meat tax of some kind, may well be on the agenda.”

Wardle said there are many examples of food industry players adapting their practices and addressing this issue through acquisitions, investment, product innovation and R&D.

US meat giant Tyson is increasing its 5% stake in plant protein company Beyond Meat while Cargill has shown support for lab-grown meat company Memphis Meat and dairy giant Danone bought WhiteWave.

“Change is afoot in the livestock and food industry,” Wardle said. “Whether this is due to a looming threat in terms of a meat tax, down to other risks such as environmental devastation and human health risks or realisation that there are market opportunities here – it is a change for the better.”

FAIRR gives a checklist of questions that concerned investors could ask food companies before parting cash:

• Has the company considered the implications of potential regulatory pressures on meat, including the possibility of a meat tax. What might the financial implications be in this scenario?

• Has the company considered diversifying its protein portfolio exploring more plant based products tapping into changing consumer demand on this issue

• Have targets been set to reduce meat content of certain composite product ranges?

• Has the company got clear meat supply standards to mitigate potential health and environmental risks. For example does its meat production supply chain seek to reduce its environmental impacts or reduce the use of antibiotics

• Are there opportunities for the company to promote healthier and more sustainable product ranges?

• Is the company using its brand equity to promote healthy and sustainable diets and lifestyles more broadly, and to educate consumers on making better choices?

The sustainability of animal-based proteins will be just one area under the microscope at Food Protein Vision, a conference powered by FoodNavigator. We will be taking a closer look at the key issues impacting the protein space - from tomorrow's innovation trends to accessing growth markets, categories and channels of today. Join us in Amsterdam in March to discover the latest business opportunities in the protein space. Click here to find out more.