The EU-Canada Comprehensive Economic and Trade Agreement (CETA) entered force on September 21, eliminating custom duties on chocolate confectionery imported from the EU to Canada, which had been up to 10%.

‘Volume will increase’

Laurence Vicca, communications manager at CAOBISCO, the Association of Chocolate, Biscuits and Confectionery in Europe, said chocolate exports to Canada would now depend on company marketing plans, but could grow.

“We are convinced the volume will increase thanks to the elimination of the import tariff,” she said.

EU chocolate confectionery exports to Canada are worth €170.6m ($200.5m) annually, according to the European Commission. This makes Canada the sixth top export destination for EU chocolate.

Belgium, Germany, the UK, France and Poland respectively are the top exporters of EU chocolate to Canada.

Rules of origin: Non-EU sugar

Zero custom duties only apply when a product meets CETA’s rules on origin. This means for chocolate that products containing more than a certain percentage of non-EU produced sugar are excluded and will be taxed.

Under CETA, Canada can choose to measure the level of non-EU sugar by weight (40% maximum) or value (30% maximum).

Vicca said the confectionery industry is pleased CETA keeps open the possibility to determine origin based on value.

“This measure will highly benefit the export competitiveness of value-added products such as chocolate, biscuit and confectionery products,” she said.

Based on value

Since 2012, CAOBISCO has lobbied for the EU-Canada free trade agreement to base the percentage of non-EU sugar on value rather than weight so confectionery products have flexibility to use non-EU sugar and retain preferential status.

Previous EU free trade agrements have calculated non-EU sugar based on weight (40% maximum), but recent deals, for example with Singapore and Vietnam, switched to weight based rules.

Other products and rules on Canadian chocolate

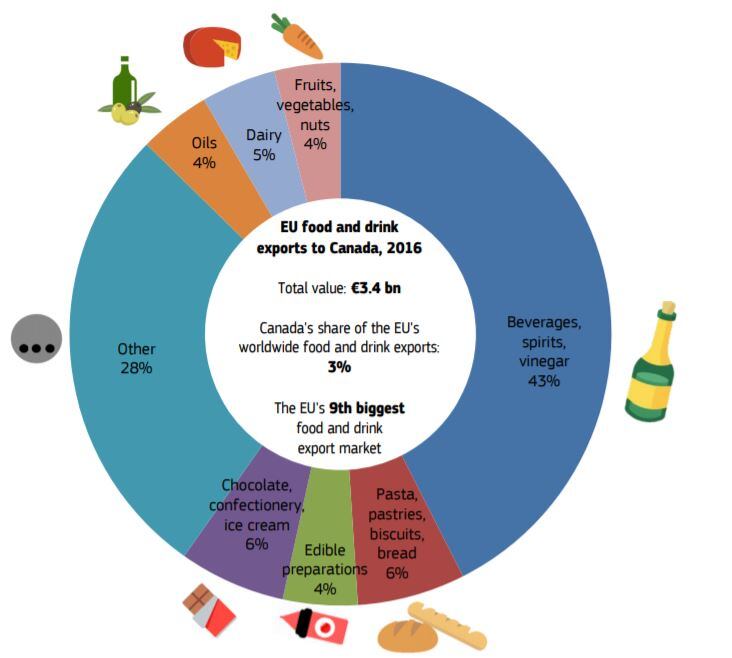

CETA also lifts tariffs for other EU food and drink exported to Canada such as cheese, wine, spirits, bread and pastries.

Biscuits – previously subject to up to 15% import tariffs – can now be exported without custom duties.

CETA also sets zero EU import duty on chocolate originating from Canada.

Canadian chocolate was previously subject to import duties averaging 8% to 25% from 2010 to 2012. The duty varied based on the value of the product and sugar content.