Going for 'good' sugar in Germany

Senior food and drink analyst at Mintel Katya Witham specialises in the German market. She says: “Although sugar has been receiving a lot of negative press, sugar and sweeteners in less processed, more

natural forms (such as honey, maple syrup) are perceived as healthier. The use of the ‘good’ kind of sugar has become especially important for categories juggling image perceptions at the intersection of health and indulgence, like snack bars.”

Lubs Rohköstlich cocoa and mint protein raw food fruit bar, which also makes organic, vegan and gluten-free claims, is an example of this.

Rarely used on its own due to lingering taste issues, plant-based stevia works well when combined with sugar for reduced-sugar formulations. “German sweet spread manufacturers have already recognised reformulation benefits using stevia and sugar blends to create all-natural reduced calorie products,” adds Witham, pointing to Zentis ‘Leichte Früchte’ light raspberry fruit spread with stevia.

Fruit fusions from Finland

Meanwhile in Finland, companies are experimenting in swapping sugar for fruit purees and fruit juices or, in the case of Arla’s Finnish brand Luonto+, a blend of vegetable and fruit purees.

"These vegetable-fruit yoghurts make vegetables appealing and approachable," says the Danish dairy which offers three flavours: raspberry and beetroot; orange and carrot; and apple and spinach.

Healthy food for all

Consumers no longer expect healthy food and drink offerings to be the preserve of high-end shoppers who can afford premium goods.

According to global Mintel analyst Jenny Ziegler: “The need to address inequality in healthy products will persist because lower-income consumers make up a large part of the worldwide consumer base: 638.3 million people globally were classified as low-income as of 2015, according to data from the World Bank.

"For lower-income consumers, access to, and the affordability of, food and drink are genuine concerns, especially because many lower income people are at risk for food-related health issues, such as obesity and diabetes.”

Source: Food and Drink Trends 2017, Mintel

Czech this out

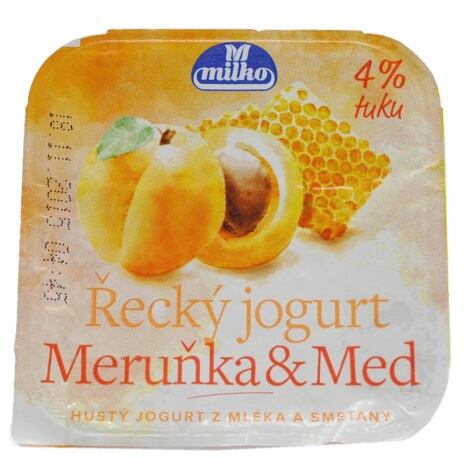

Recent low sugar launches in the Czech yoghurt categeory have used non-nutritive sweeteners such as aspartame and acesulfame K. But as these are steadily falling out of favour across the world, food and drink analyst at Mintel Honorata Jarocka suggests that Czech brands could look to explore non-artificial alternatives to white sugar, such as agave syrup, coconut sugar and stevia.

“A number of Czech brands have also recognised a window of opportunity to incorporate honey into yogurt, not only for its sweetness but also healthfulness and flavour.”

Honey products currently finding success on the Czech market include both international and local brands as well as retailers. Molkerei Alois Müller’s Greek style mix honey & apricot mousse; hard discounter Lidl’s Eridanous Greek style yogurt drink with walnuts and honey; Polabské Mlekárny’s apricot & honey flavoured Greek yogurt and Zott’s Natura yogurt with honey.

Brits relax despite the tax

Over in the UK, the government’s 2017 sugar tax, as well as campaigns by high-profile health associations such as Action on Sugar, are fuelling the sugar-free drive.

According to Michael Hallsworth, director of health and tax at The Behavioural Insights Team, a social purpose company jointly owned by the UK government, this shows that the UK’s sugary drinks tax is working before it has even come into effect because the government made the announcement two years before it is due to come into effect. This has given manufacturers the time to reformulate their products below the two bands

Hallsworth had predicted that manufacturers would “respond positively” to the tax but said it was unclear how far and fast this would happen.

This month has seen two significant announcements – the country’s biggest retailer Tesco announced all its own-label soft drinks would be reformulated to escape the tax. The manufacturer of Lucozade and Ribena made the same announcement two days later, meaning their brands will contain at least 50% less sugar.

“Given these significant changes, we can expect many other producers to follow suit. This means that, interestingly, the soft drinks levy is starting to have a large impact even before it comes into force – not by affecting purchases, but by influencing producers,” says Hallsworth in an online post.