Drawn from 26,000 packaged food and beverage products and hot drinks (excluding private label) across 26 countries across the world over one year, the data reveals the extent to which ethical labels have come to change the way the food we eat is marketed and perceived, sourced and manufactured.

It reveals that ethical labels on packaged food and drinks were worth a massive $794 billion (€709bn) worldwide last year.

“This is bigger than the whole market for health and wellness,” Euromonitor analyst and head of nutrition and ethical labels research, Ewa Hudson told FoodNavigator. “It’s not a small trend by any means.

The market research company looked at a total of 38 ethical labels, divided into three categories: people and values (which includes claims of clean label ingredients, locally sourced, and religious claims such as halal or kosher); environment and sustainability (including recycling, responsible forestry and sustainable trade and farming such as Fairtrade); and animal welfare (such as free-range, grass-fed, marine sustainability and vegetarian or vegan claims).

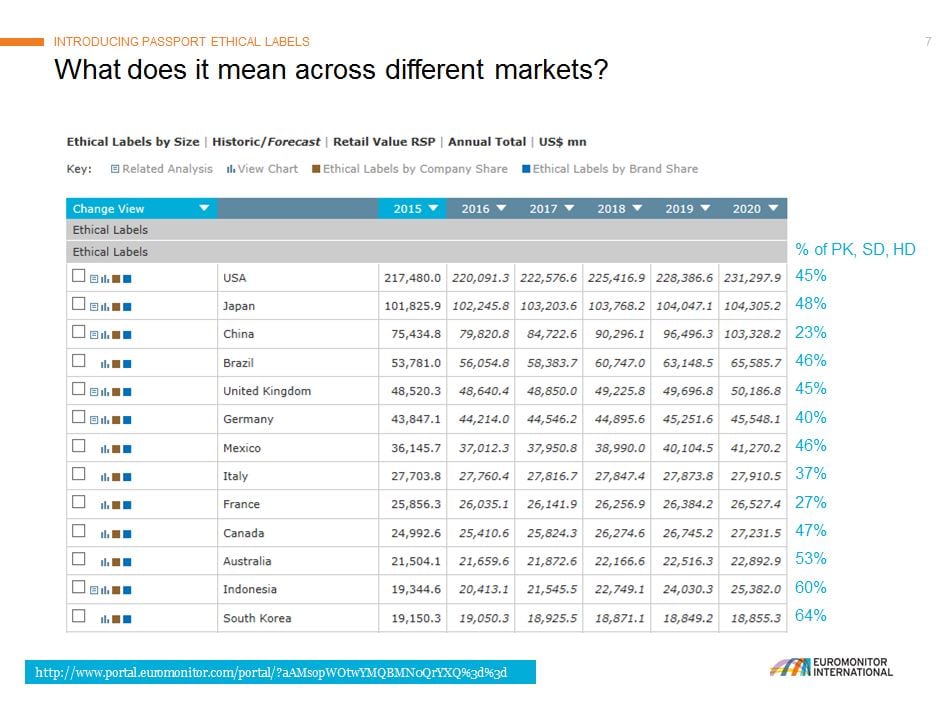

In the UK 45% of all packaged food, soft drinks and hot drinks bear at least one ethical label, and its value is set to rise by around $1.6bn (€1.47bn) between 2015 and 2020. In Germany, around 40% of surveyed products bore an ethical claim, compared to 37% for Italy and 27% for France.

For South Korea, this rises to a massive 64% and 60% for Indonesia.

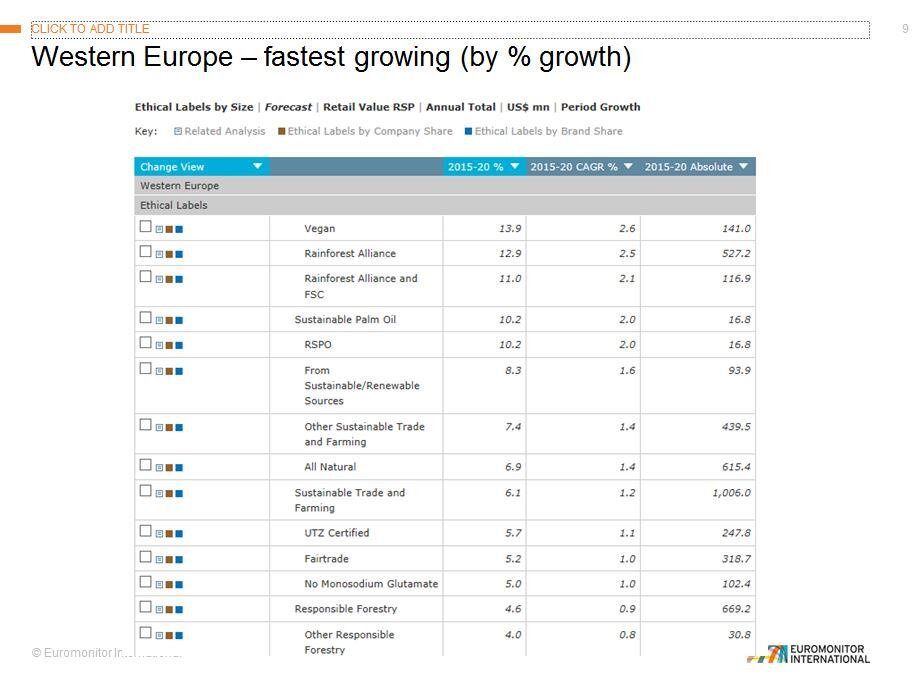

The fastest growing claim in Western Europe is vegan / vegetarian which is set to grow by 13.9% over the next four years. This is followed by Rainforest Alliance-certified products. Certified sustainable palm oil will grow by 10.2% and ‘all natural’ claims by 6.9%.

The data also reveals just how rapidly the clean label movement – typified by claims such as ‘free from artificial flavours, colours or preservatives’ – has come to dominate. Currently worth around $165bn (€147bn). It is fast on the tail of well-established religious claims, such as kosher or halal, that are valued at $195bn (€174bn).

Which label is best for your product?

The most popular labels worldwide relate to recycling, local sourcing, religion (kosher, halal or other) and clean label. But how can companies know which label is best for their specific product? It depends on the country you are targeting, the category of food and the percentage uptake of the label.

“In Europe the market is very saturated and growth for packaged foods is limited so it’s important to know where the value is coming from,” Hudson said.

Manufacturers want to choose a label that is niche enough to differentiate them from other competitor brands but that will still hold appeal with a broad base of consumers.

For chocolate manufacturers in the UK, for instance, vegan and Rainforest Alliance-certified products are set to see the fastest growth rates (8.7% and 6.5% respectively) but Fairtrade will generate much greater absolute growth - worth $154.5 million (€138 m) by 2020 according to the passport data - and is therefore the label to go for.

In France, on the other hand, Fairtrade is forecast to experience a decrease in retail value, falling from $103.6m (€92.5m) to $92.2m (€82.3m). Manufacturers would be better investing in a UTZ certification,

according to the data, which will rise from $431.1 m (€384.8) to $441.2 m (€394m).

Meanwhile US confectionery brands may prefer to invest in natural claims which offer the greatest competitive advantage even though kosher is bigger in terms of retail value.

“[The figures] show that if you want to target the US market being kosher certified is nearly a necessity,” said Hudson - it offers little in the way of differentiation in a country where the kosher market is 18 times bigger than Israel’s.

Sometimes adding the right ethical label can make a big difference for relatively little input – such as in the case British bread manufacturer Kingsmill. Euromonitor ethical label analyst Alan Rownan said: “They realised they didn’t have to make any major reformulations to get halal certification so went through a third party certifier, added the claim on their pack and saw a big rise in demand, especially for a traditional category that’s quite stagnant.”

So are we getting to the point where the market has become saturated with ethical labels and the situation has done an about turn where they no longer differentiate?

“It depends how you look at it, companies are responding to a demand from consumers. Certainly lots of labels on a product could take up a lot of space and get very crowded and it will certainly take some attention away from health claims.”