“Located at the crossroads of European trade and transport routes, [Poland] is a huge market with 38.5 million consumers,” food and drink analyst at Mintel, Honorata Jarocka, told FoodNavigator.

“A growing proportion of them are increasingly adventurous and experimental, demonstrating openness to new taste experiences. Moreover, as more and more Poles travel abroad on a regular basis (both for work and leisure), learning new cuisines and cooking styles, interest in recreating the new recipes when back home is on the up. This suggests further development opportunities for foreign food and drink producers,” she said.

With a 51% increase in the number of new product launches between 2013 and 2015, including new formulations, packaging and product extensions, Poland’s food and beverage innovation is booming. According to Mintel, the country accounted for over one third (34%) of all food and drink launches in the Eastern European region in 2015

So what are Polish consumers looking for in food and drink?

A Mintel report on the top food and drink trends to emerge in 2015 had predicted that health and wellness concerns would dominate - nearly two thirds (64%) of Polish adults said they were actively reducing their consumption of sugary foods and 57% expressed concerns about artificial sweeteners – and this can be seen in the on-pack claims of many of the

launches.

Piątuś, a Greek style yogurt for children, is free from both artificial colours and flavours, and also features a front-of-pack ‘no high fructose corn syrup’ claim. “[This] is a novel positioning in Poland. Yet, this strategy definitely adds stand-out appeal and helps engage with health-driven parents looking for simple and easy to understand ingredients, preferably of natural origin,” says Jarocka.

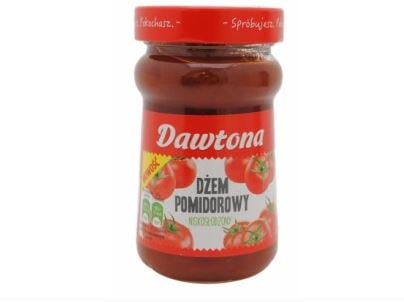

Sweet and savoury hybrid flavours can tap into the search for unique flavours and new taste experiences - such as ZPOW Dawtona's tomato-based jam - while using superfood ingredients such as greens, grains or seeds can give a healthful boost. Polish start-up Raw and Happy recently launched Gryczanki, buckwheat snacks that are organic, raw, gluten-free and contain no refined sugars.

If some of these trends sound familiar to Western European food manufacturers, it’s because they are.“The Polish food and drink market is increasingly innovative; however it can still be seen as a follower, or in some cases an early adopter, when compared to what is happening in Western markets,” said Jarocka, pointing to the fact that only 8% of Polish dairy launches in 2015 featured a low- or no- lactose claim compared with more than 18% in neighbouring Germany.

“Nonetheless, there are examples of creative companies which are exploring some novel positionings – also rarely seen across the global market – aiming to stay one step ahead of the competition. One such

company is Ronzo, a Polish start-up, which looks to attract consumers to eating insects with its range of all-natural snack bars based on cricket flour,” she said.

Meanwhile Mokate has launched Loyd’s wine flavoured tea – available in white, red or rosé. Describing the teas as if they are actually wine, Mintel says they have the potential to excite both wine connoisseurs,

tea lovers and those looking to cut down their alcohol consumption.

Data released by the Agencja Rynku Rolnego (Agricultural Market Agency), agricultural and food imports to the country grew by 4.7% in 2015, reaching a value of €15.9 billion, while exports for the same period generated €23.6 billion.