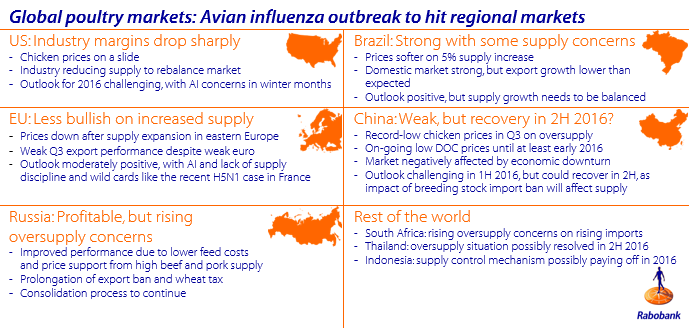

This drop represents a “significant decline and is an indicator of the high volatility” in the global poultry market, said Rabobank analyst Nan-Dirk Mulder.

In the report – Poultry Quarterly Q4 – Rabobank stressed that the poultry industry had a “positive outlook” for 2016. However, this year has been one to forget for chicken producers.

“Leg quarter prices in US dropped 45%, US breast meat prices dropped 30%,” said Mulder.

He added: “EU breast meat prices dropped 10% and Brazilian whole chicken prices dropped by 10%” in the last quarter of 2015 when compared to last year.

“In the case of China, there are very limited sourcing options left. France has become their major supplier after the ban on US poultry. Without any change in sourcing, the poultry market will be extremely tight in China in 2016.”

Oversupply and dwindling demand for chicken was the catalyst for a bad year. But the bird flu outbreak in the US – which resulted in China’s aforementioned ban on American chicken – was also a “big factor”, said Mulder.

Despite the changes made to the US poultry market – which includes improved biosecurity measures and better training – bird flu remains a “wildcard”.

The outbreak of the deadly H5N1 bird flu strain in France has exacerbated the prospects of poultry in 2016. This will impact global markets for chicken meat as well as breeding stock and “such uncertain, volatile market conditions require a restrictive supply discipline”, said Mulder.