Rapid growth in salt replacement ingredients, coupled with gradual salt reduction globally shows that cutting salt is still a major focus for manufacturers. However, limited use of ‘low’ or ‘reduced’ salt claims on pack suggests that more and more companies are taking a quiet approach.

According to RTS Foodtrending, the market for salt replacement ingredients in Europe, the Middle East and Africa (EMEA) grew by 56% in volume and 51% in value between 2008 and 2013 – with the market expecting to see around 30% growth each year until 2018.

Such growth in salt replacement ingredients has coincided with slow but steady reductions in the level of salt found in many products globally, according to data from Mintel. Indeed, the UK has seen dramatic reductions thanks to policy interventions driven by Consensus Action on Salt and Health (CASH), while the US has seen falling salt levels in certain sub-categories.

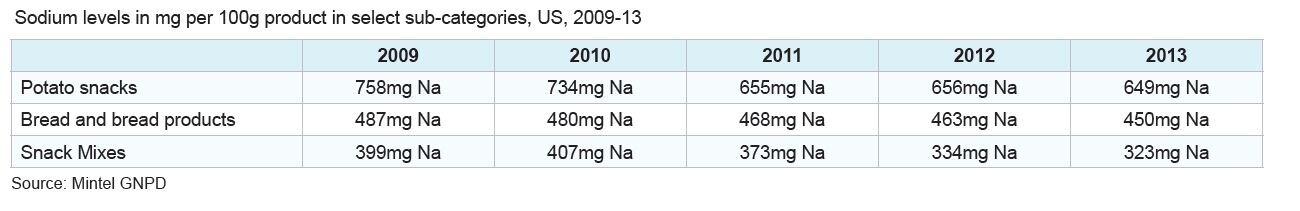

For example the US market has seen sodium levels in potato snacks decrease by 14%, with a 23% fall in sodium for snack mixes, and nearly 11% in bread and bread products.

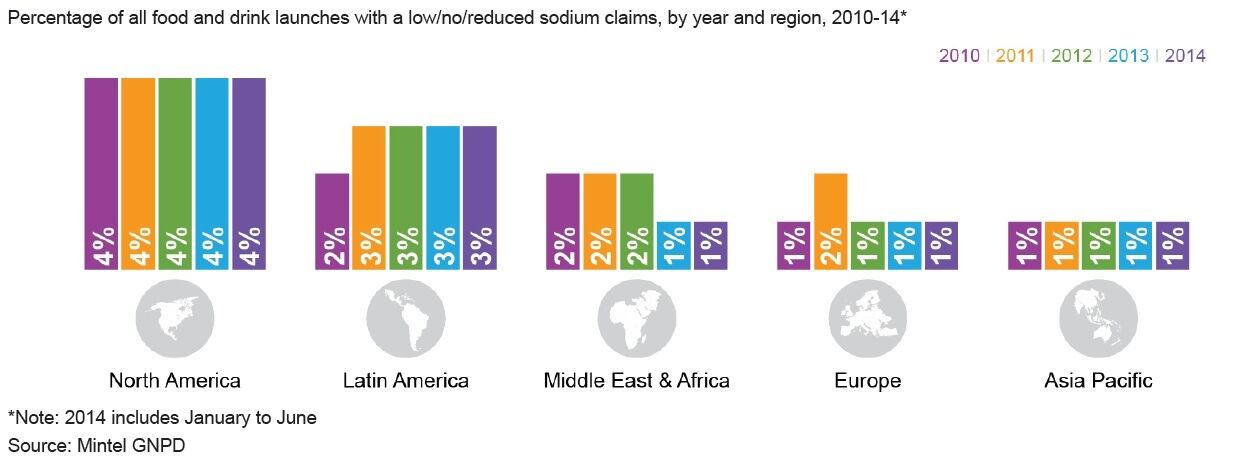

Meanwhile use of ‘low’ or ‘reduced’ salt claims on food packaging remain fairly flat in almost every global region. According to Stephanie Pauk of Mintel, this suggests that many manufacturers are favouring a stealthy approach to salt reduction.

“Use of low, no, or reduced sodium claims globally on packaged foods has been relatively stagnant, appearing on less than 4% of food and drink products launched globally between 2010 and June 2014 … which suggests that companies are engaging in a stealth approach to sodium reduction,” said Pauk.

“By reducing sodium slowly over time, changes are less noticeable and are more palatable,” she added.

Laura Jones of Mintel also noted that taking a quiet approach to salt reduction may be of benefit for consumer preferences – noting that sodium-reduced products “are often perceived as tasting inferior to their higher-sodium counterparts”.

Such gradual reductions in sodium are slowly reshaping consumers’ salt preferences, suggesting that their taste buds may be adapting to less salty products.

“Back in 2010 when US consumers were asked about the taste of low in salt/ sodium products compared to their traditional counterparts, 45% agreed that the lower salt/sodium versions tasted inferior. However, when asked the same question in 2013, only 21% of US consumers agreed that low sodium foods do not taste as good,” explained Jones.

Growth in table salt

Despite continued efforts to reduce salt levels in finished products, Mintel data also shows that there has been a steady increase in table salt in Europe since 2011.

David Turner of Mintel said the penetration of premium sea salt varieties is high in many European markets.

“Sea salt is often highlighted as a positive feature in processed food launches,” said Turner. “Often products containing sea salt claim to be more ‘natural’, contain ‘essential minerals’ and are ‘healthier’ than alternatives that use standard salts. Although elements of these claims are accurate, they are frequently overstated.”

Despite relatively high sea salt sales, the message to reduce salt does appear to be reaching a significant number of European consumers, he added, particularly among older people. More than a third of over-45s in France, Italy, Spain and Poland agree that they are reducing the amount of salt they eat for health reasons.

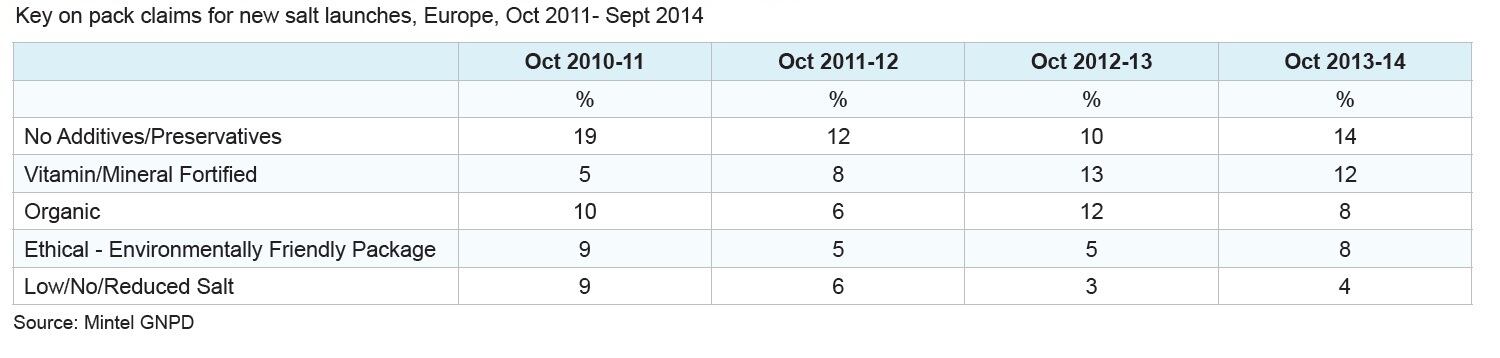

“Perhaps in reaction to declining sales there has been a steady increase in the number of new table salt launches in Europe since October 2010, though the rate of increase has tailed off in the last year,” said Turner.

“Salt producers have also looked at a number of different added value routes to boost sales. Vitamin and mineral enriched claims, usually focussed on iodized salts, or those with added fluorine, rose from 5% of all launches the 12 months to September 2011, and peaked at 15% of launches a year later before falling back to 11% in the last 12 months,” he added.

Turner also highlighted the use of salt provenance “as a reinforcement of natural purity”.

Some salts claim Himalayan heritage, for example, often in combination with claims regarding their purity and pollution-free nature.

“We are likely to see more premium gourmet salts focus on provenance and linking this origin to claims of purity and naturalness particularly if sourced from remote and exotic locations,” he said.