Steinemann, in his role since 2009, will step down at the end of fiscal 2014/15. Barry Callebaut is searching for his successor, but hopes to appoint Steinemann to its Board of Directors.

Results rundown

For fiscal 2013/14, Barry Callebaut’s sales revenue rose 20.1% to CHF 5.8bn ($6bn) and net profit was up 14.5% to CHF 255m ($262m).

The firm saw its biggest sales growth in Asia-Pacific (+12.2%) followed by Europe (+9.4%) and the Americas (+8.8%).

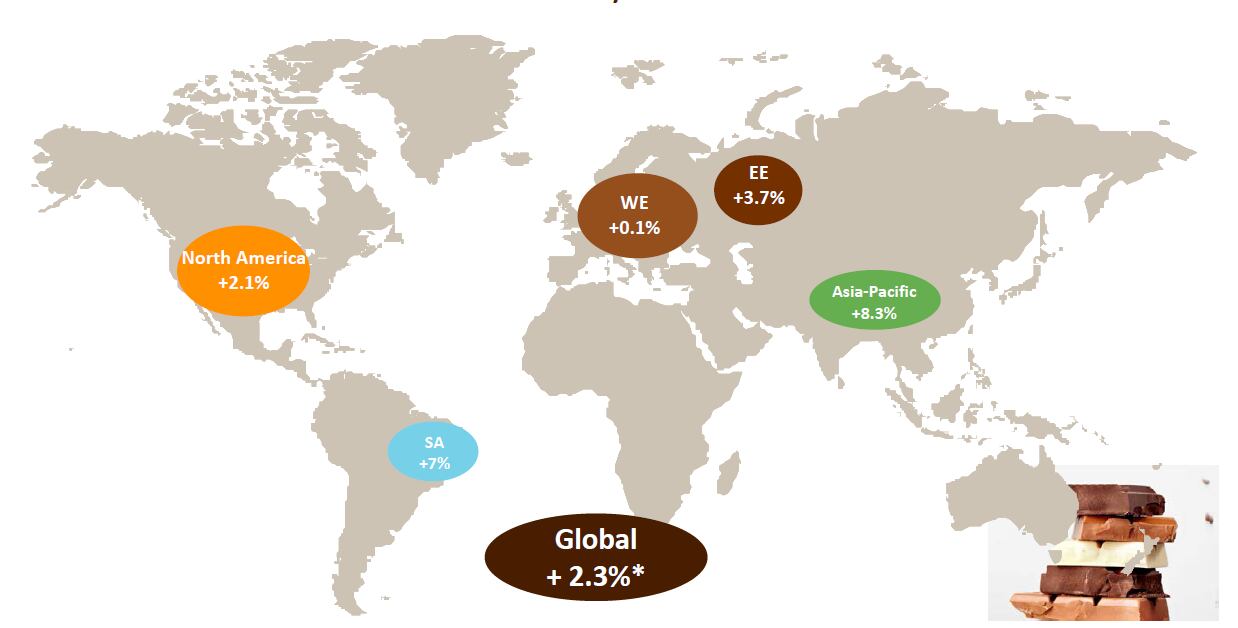

By comparison, the global chocolate confectionery market grew 2.3% from September 2013 to August 2014, according to Nielsen, while Euromonitor estimated a 1.5% rise.

Petra and outsourcing

Barry Callebaut’s Global Cocoa division sales revenues rose 55.8%, driven by the addition of Petra Foods’ ingredients arm last year.

Steinemann said during the company’s earnings call yesterday that the Petra integration had been a success. “We did not lose any customer, we did not lose key people and we are well on track for our business case and synergies.”

The company’s long-term outsourcing partnerships division also grew 8.7% in volumes due to deals with Mondelēz, Hershey, Unilever and Grupo Bimbo.

Barry Callebaut benefited from a 25% rise in cocoa prices during the year as it passes the majority of these costs onto its customers.

Ebola and the cocoa supply

The company said that the cocoa market continued to be bullish in spite of forecasts of a slight surplus for the last crop year.

“It has been fuelled by fears related to the Ebola outbreak in some West-African countries bordering Côte d’Ivoire and Ghana, el Niño forecasts, a potential cocoa shortage by 2020, as well as financial speculation,” it said in its release.

Steinemann said that Barry Callebaut had no production facilities in countries affected by Ebola and pointed out that there had been no confirmed cases in the big producing countries, Ghana and Côte d’Ivoire.

“Our operations and sourcing activities in these two countries are ongoing as usual and cocoa is arriving in the ports in good quantities and quality.”

Forecast and combined cocoa ratio

But additional hygiene measures have been adopted in the company’s plants and Barry Callebaut has contingency measures to move capacity to other regions if necessary.

Barry Callebaut said it was confident it would reach its mid-term target of 6-8% average volume growth and would restore EBIT per metric ton to pre-Petra acquisition levels (CHF 265 per MT) by 2015/16.

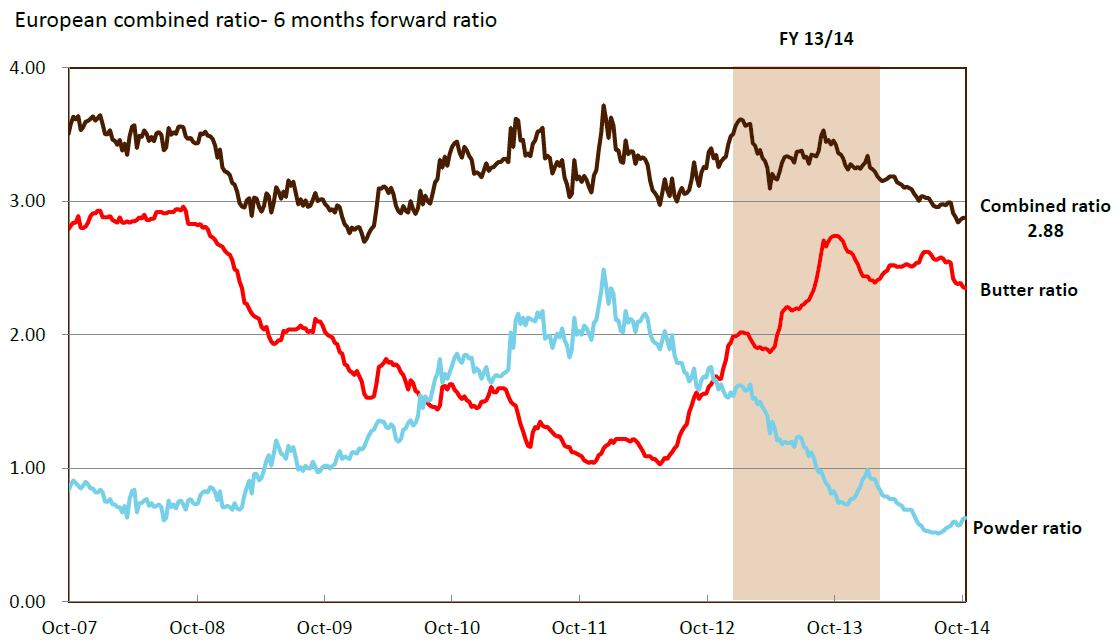

Barry Callebaut CFO Victor Balli, said: “We continued to see powder prices declining to very low levels. As a result of these declining prices, cocoa processors reduced grindings, which affected the supply of butter, triggering a steep increase in butter prices.”

The combined ratio, which determines profitability for cocoa ingredient suppliers, has been falling throughout the year.

“The situation is not improving…therefore we expect a negative profitability impact for the first half of our year but we have an expectation that he situation might improve in the second part of the year.”