On Monday, Cargill announced it was acquiring all of ADM’s six chocolate plants as well as the Ambrosia, Merckens and Schokinag brands for $440m.

“The transaction means that Barry Callebaut and Cargill are the top two global cocoa manufacturers. Is that such a bad thing? A duopoly, especially in a volatile industry such as cocoa, could be a risk,” said Marcia Mogelonsky director of insight at Mintel.

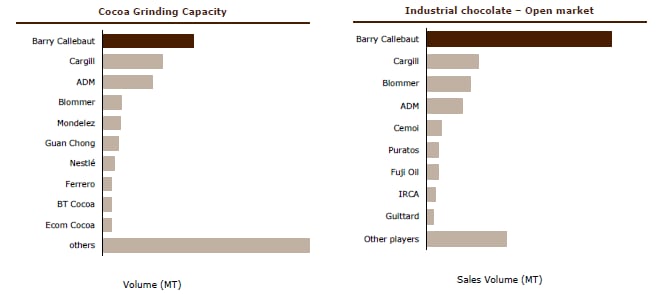

According to a graph in Barry Callebaut’s 2013 results, Cargill has extended its lead in industrial chocolate over Blommer, but it still trails Barry Callebaut on volume sales after the ADM chocolate buy.

“It does create a two horse race, but they won’t be overtaking Barry Callebaut,” said Lauren Bandy, ingredients analyst at Euromonitor. “Cocoa is already an oligopoly…but it does limit the choice to some extent.” She said that Cargill had hoped to take over both ADM’s chocolate and cocoa processing operations for around $2bn after Barry Callebaut leapfrogged Cargill as the world's premier cocoa processor after acquiring Petra Foods. However, she said Cargill was concerned anti-trust authorities would block the move.

Cocoa volatility

Both Cargill and Barry Callebaut pass on the majority of raw material costs such as cocoa to their customers, but Mogelonsky said that Cargill could absorb some costs to gain a competitive advantage.

“Cargill could try to not pass price hikes on to the manufacturers for a while and keep prices level - absorbing any price hikes in the short term as a way of gaining and securing business.”

“But this is just a very short term solution. They will have to pass the price hikes on as Callebaut is doing. It is unavoidable,” she said.

Bandy concurred: “Prices are going up and they might have to start passing on more costs anyway.”

Cocoa prices have been on the rise since the start of the year and were 32% higher in August compared to the same period last year, according to the International Cocoa Organization (ICCO). The organization expects a 30,000 metric ton (MT) surplus for the 2013/14 season, but a 100,000 MT deficit every crop year up until 2020.

Credit ratings agency Moody’s said yesterday that Cargill’s acquisition of ADM’s chocolate business would have no impact on Cargill’s A2 stable credit rating.

Chocolate demand

Mogelonsky said that Cargill could take heart that demand for cocoa products was continuing to grow in developing countries.

“It is possible that developed markets could see a slacking off in demand - we've seen some of this in the UK already - but it has to be remembered that Cargill and Callebaut are providing cocoa for a range of finished products beyond chocolate confectionery.”

“We may see consumers be a bit skittish about spending on chocolate confectionery but that does not necessarily mean they are stopping their consumption of chocolate - they are just spreading that consumption across a range of categories from chocolate confectionery to biscuits, ice cream, and cereal.”