Weight loss no longer primary motivator for sugar reduction: consumer research

Following a global pandemic – with more than two years of health, wellness, and immunity put front-of-mind – it is unsurprising that consumer perceptions around some foods are changing.

Sweetness is one area where taste and nutrition-focused Kerry Group has observed a shift among consumers. These days, people are questioning ingredients, are more cautious about accepting alternatives, and are deliberating on the impact of sweeteners on their health.

The ingredients supplier is also aware of consumers being ‘savvier than ever’ to the type, source, and amount of sweeteners in their food and drinks.

In working to better understand these changes, Kerry’s consumer research and insights experts conducted a quantitative survey of 12,784 people across 24 countries and six continents.

“We wanted to step back and see how – post-pandemic and [amid] geopolitical issues – behaviours, lifestyles and priorities had changed,” Soumya Nair, global director of consumer research and insights at Kerry explained. “Under this light, we also wanted to understand if the emotional and functional relationship with sweetness had changed or not.”

As expected, all have changed – with some behaviours and perceptions shifting to ‘seismic’ degree.

Proactive health over weight loss

Unsurprisingly, sugar reduction is still a priority for consumers. But one of the ‘big truths’ uncovered lies in the primary drivers behind consumer desire to cut back on the sweet stuff. According to Kerry, weight loss is not consumers’ only concern, ‘proactive health’ is.

“If I had done this piece of research five or 10 years ago, [consumers] would have said they wanted to reduce sugar because it was better for their health, it can [help them] lose weight and look good. It was all about weight reduction before.

“But now… weight loss is not the primary motivator for sugar reduction,” Nair told Food-Navigator Europe, “which is a seismic shift”.

According to the survey, 79% of consumers increasingly acknowledge and turn to reduced sugar products as healthier alternatives. Among almost all age groups, the top health concern and perceived drawback of sugar consumption was not that it ‘leads to weight gain’, but that it ‘causes diabetes’.

“An overwhelming majority were thinking about sustainable health… and long-term healthy ageing.”

Desire to reduce sugar can change throughout the day

The second significant finding from the research was that consumers don’t have a blanket rule or an unwavering perception of sugar reduction across all product categories and meal occasions.

“People don’t think about sugar reduction with the same intensity throughout the day and throughout separate occasions,” explained the consumer research and insights lead. The same person may want to cut out sugar entirely in the morning, consume products with no sugar reduction at midday, and by the evening want to eat sugar reduced food and drink.

“We realise there is a spectrum that exists and indulgence is at the heart of that spectrum. The level of indulgence to a certain occasion and to a certain product… influences consumer decisions [around] sugar reduction.”

That does not mean that the sugar reduction priority disappears, it’s still very much present, Nair explained. But there are varying degrees and intensities when it comes to a certain occasion and a certain product category.

More than a third of younger consumers sceptical of sugar replacers

The other survey findings are also significant.

Younger consumers were found to be ‘breaking the norm’ when it comes to sweetener preferences among different generations. Gen Z and younger Millennials are placing greater importance on sugar in food and drinks, with 36% of these consumers sceptical of ingredients used to replace sugar in food and drinks.

Ninety-two percent of younger consumers said they preferred honey, sugar, coconut sugar, and palm sugar significantly more when compared to older generations.

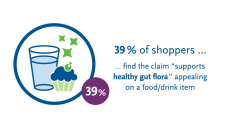

The survey also revealed that natural sweeteners rank highest across the globe, with 75% of global consumers saying they prefer a natural sweetener (such as honey, sugar, or stevia). Those who did not prefer artificial sweeteners said they were bad for one’s health (55%) and had harmful side effects (41%).

The top five most preferred globally were honey, sucrose/sugar, stevia, coconut sugar, and fructose.