‘The street fight has already begun’: The winners and losers as inflation bites

A new report from the data provider describes the current economic uncertainty across G20 nations as ‘imperfect inflation’, typified by a major convergence of several demand and supply factors, including rising commodity and energy prices and supply chain disruptions.

“We've never seen a convergence of so many demand and supply factors at once since the 1920s,” said Ananda Roy, SVP, Strategic Growth Insights, IRI International.

"So as you can imagine the street fight has already begun. Manufacturers, retailers are trying to maintain volume, margin and ultimately growth."

The industry therefore needs to mitigate inflationary pressures by adopting a new approach, IRI revealed, and using the whole marketing toolbox beyond established revenue and price management principles.

The categories in and the categories out

IRI analysed 40 FMCG brands that have successfully mitigated past inflations to reveal the key characteristics – and to show manufacturers how they can be more resilient within their categories.

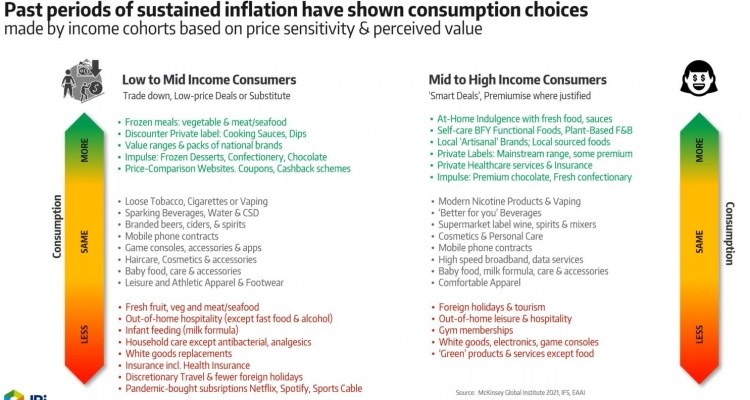

IRI’s analysis includes a survey of 3,000 consumers in 12 countries, which reveals a gap between low- to mid- income cohorts seeking to trade down and mid-to-high income cohorts looking to premiumise where justified.

The former group will provide opportunities for frozen meals, discounter private label cooking sauces and dips, value ranges and impulse items such as frozen desserts, confectionery and chocolate. Categories to suffer will include fresh fruit and veg and meat/seafood.

By contrast, mid to high income consumers will demand at-home indulgence with fresh foods and premium chocolates, functional foods and locally sourced foods.

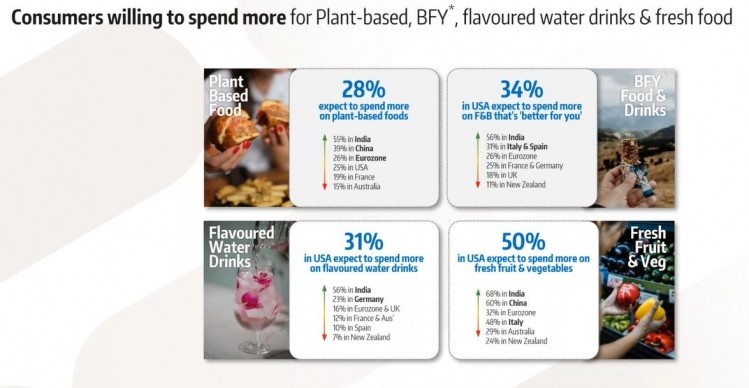

Despite the context of inflation, these consumers told IRI that they were willing to spend more on areas like plant-based, better-for-you, functional foods, flavoured water and fresh fruit and vegetables.

“Mid to high end consumers are downtrading, but the attitude is more about finding smart deals,” elaborated Roy. “They are very happy to premiumise when it’s for at-home indulgence, for self-care using functional food and drink, or for local or artisanal brands. They are also interested in impulse, but with fresh and premium chocolate rather than making compromises on indulgence.”

Some segments that grew during the pandemic are likely to stay elevated added IRI. These include sports and energy drinks that give resilience through the day, and products such as yoghurt drinks, perceived to give you gut health and immunity.

Growing segments include savoury snacks, deserts, because consumers are demanding indulgence, as well as health and immunity.

As mobility meanwhile gradually recovers to pre-pandemic levels, consumers intend to continue to cook fresh at both in their home and out-of-home occasions, predicted IRI. This it said illustrates the desire to take control of their health and moderate expenses.

The ‘squeezed middle’

IRI’s inflation analysis further identified the phenomena of the ‘squeezed middle’. Large manufacturers and private labels, for example, are more able to mitigate the effects of inflation. Mid-sized and smaller manufacturers and retailers, however – the ‘squeezed middle’ – face margin erosion and sales value declines with the added threat of price wars.

Mid-sized companies therefore need to be aware of the challenge of forthcoming price wars, said Roy. “There is likely to be indiscipline in the second half of 2022 where those small and mid-sized manufacturers who are at greatest risk of volume and margin decline succumb to price wars. If your inflation mitigation strategy does not account for price wars especially in the second half of 2022, we believe that it is perhaps an insufficient strategy.”

Characteristics of inflation-busting brands: more recommendations for companies

Target consumers with greater precision

High performing brands think of inflation as an opportunity because consumers are actively re-evaluating their consumption habits and relationship with brands. They invest in understanding changing needs and behaviours that are likely to shift demand and offer growth opportunities. They also re-align their marketing portfolio, pricing, distribution, revenue management, and brand mix to ensure they are in the right markets with the right product at the right price.

Behave counter-intuitively

They ‘invest in the trough’ by adapting in the short term but staying consistent in the long term. This may include counter-intuitive behaviour like reducing innovations and investing that marketing budget in trade promotions (while phasing innovation for recovery), and partnering with other businesses and rivals on transportation and distribution to cut costs. In addition, they never compromise on the brand promise – quality, trust, ethics and sustainability goals are not replaceable.

All brands are equally vulnerable

High performing brands recognise that Premium, Mainstream and Private Label are all equally vulnerable to the effects of inflation and recession. This includes price increases due to unpredictable factors, threat of price wars, consumer up- or down-trading, and lack of availability in the right stores.

Unique situations require fresh thinking

With consumer confidence falling, ongoing fears over COVID, and a widening gap between rich and poor, the industry needs to mitigate inflationary pressures by adopting a new approach, and using the whole marketing toolbox beyond established revenue and price management principles.

According to IRI, shoppers are less likely to react to marginal price increases and more likely to react to ‘sticker shock’, such as big price hikes at the forecourt or rising energy bills. This reflects the gap between headline inflation rates and forecasts and actual changes in consumer purchase and consumption behaviour.

Roy added: “Shoppers in-store may be too embarrassed to return items once they get to the till and discover they have spent too much, but will change their behaviour next time, either buying less, looking for deals, or switching to another retailer. With more of us shopping online, it’s easier to manage spending and make adjustments in order to stay within budget without embarrassment.”