Coronavirus era puts resilience of supply chains ‘front and centre’ warns Kellogg

The latest EY annual attractiveness survey – which examines the performance and perceptions of European countries as a destination for foreign direct investment (FDI), revealed that post-COVID-19 there will be an additional lens front and centre: the need to juggle cost and resiliency.

“In recent years, outside of people and food safety, which will always be the main priority, businesses such as ours have looked at their supply chains primarily through the lens of cost as an enabler to margin expansion,” wrote Robert O’Sullivan, Vice President of Finance Kellogg’s Europe, in the EY report.

“Post-COVID-19 there will be an additional lens front and centre: resiliency. The challenge will be to find the right balance between the two. Those with a resilient supply chain have seen huge competitive advantage in the recent period of COVID-19, and I think this will continue in the longer term.”

How can businesses ensure supply chain resiliency? Businesses in the food and beverage sector will ‘look at everything’, he noted, though he ruled out any ‘knee-jerk reactions’.

“There may be some relocations and nearshoring but, given that the main risk is security of supply, the immediate priority will be to change the KPIs when evaluating suppliers and doing everything possible to improve certainty. This could mean, for example, dual- or triple-sourcing to ensure security of supply.”

Technology adoption, sustainable practices and supply chain reorganisation

How will companies look to reconfigure their supply chains for resilience and agility? EY said it believes that COVID-19 will accelerate three pre-existing trends: technology adoption, sustainable practices and supply chain reorganisation.

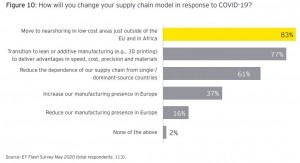

Rather than a massive reshoring movement (where companies return the production and manufacturing of goods back to the company's original country), 83% of the surveyed executives expect a regionalization of supply chains, with a rapprochement of certain production sites and their value chains at the borders of the EU and Africa (see Figure 10).

In parallel, some onshoring of business-critical activities will happen and help create a more agile value network and restart production, while mitigating risk of disruptions in the future.

Location considerations aside, 61% of businesses expect to enhance agility by reducing their dependence on single-/dominant-source countries.

Technology will also be leveraged to improve supply chain resiliency. Almost 80% of businesses plan to transition to lean or additive manufacturing (e.g., 3D printing) to deliver advantages in speed, cost, precision and materials.

Technology also has a role to play in keeping manufacturing facilities open by improving health and safety: for example, technologies will be deployed to track employee health, reduce human-to-human interactions and improve ventilation.

France overtakes UK as top destination for FDI

France, meanwhile, overtook the UK to became Europe’s top destination for FDI in 2019, attracting 1,197 new projects, a 17% annual increase. Despite Brexit uncertainty, FDI in the UK climbed 5%. Investment in Germany remained stable.

Europe’s agri-food business was among the top 15 sectors in the report, attracting 377 FDI projects last year for a 6% market share. The projects created over 11,000 jobs in the region, which made up 4% of the total number of jobs created.

The EY report observed that FDI projects in Europe’s agri-food sector are among those it expects ‘to be very hard hit’ by the pandemic. It added that results are sobering, ‘but certainly not discouraging’. For example, 9 out of 10 surveyed businesses expect to decrease or delay investment plans this year, though 51% only plan to do so to a minor extent.

“The exact impact on investment levels will, of course, depend on the extent to which the global economy recovers and how FDI is incentivized at a local level,” it noted.