Is plant-based reaching saturation? Innovation opportunities in a meat-free market

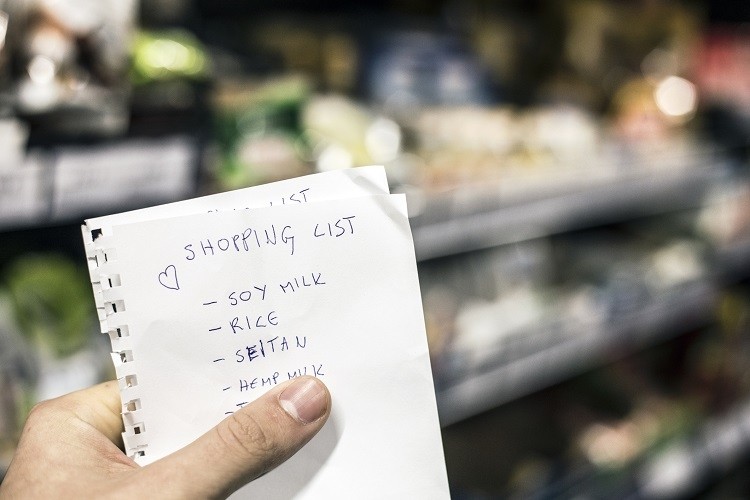

Multinationals, start-ups and entrepreneurs in the UK are working hard to meet growing demand for meat-free options. According to Mintel, 2018 saw the UK launch more vegan products than any other nation.

Industry will have to continue on this trajectory. By 2025, it is predicted that vegans and vegetarians will make up a quarter of the British population, with flexitarians expected to account for under half of all UK consumers.

So which plant-based foods are reaching UK retailer shelves? And if some categories are reaching saturation, where are the gaps challenger brands should be aiming to fill?

Looking beyond the burger ‘hype’

Whether consumers are cutting out meat for environmental, animal welfare, or health reasons, the plant-based trend is ‘definitely not a fad’, according to Sainsbury’s senior ready meal and meat-free buyer, James Hamilton.

The category expert has seen a dramatic increase in the amount of plant-based offerings pass across his desk in the past 12 months. “There are stacks,” he revealed at start-up event Bread and Jam in London last week, “there is loads of choice”.

While Hamilton said he does not see any ‘massive gaps’ in plant-based innovation, he did suggest that the burger analogue category is fast-approaching – if not already surpassed – saturation point. There is ‘too much hype’ in burgers, he told delegates during a panel discussion. Approaching this category could indicate ‘a lack of thinking in business’. “So if you are going to bring a burger, it has to be a different take on it, doing it in a completely different way.”

Soy and coconut-free dairy

It comes as no surprise that for Oatly UK’s general manager, Ishen Paran, the target market for plant-based innovation is dairy.

The Swedish oat milk brand has achieved significant growth in the UK market. The company’s 2018 turnover for this market alone reached £18m, marking an 89% increase from 2017 figures. Turnover for this year (2019) is projected to reach £30m.

Although best known for its oat drinks, the brand has expanded into other dairy-free categories and now sells a non-dairy creamer, a crème fraiche alternative, and a ‘whippable’ vanilla custard.

“There are still big categories that don’t have a huge amount of choice,” said Paran, citing yoghurt as one sector with plant-based market potential. As it stands, the non-dairy yoghurt market is largely made up of soy-based or coconut-based products. However, consumers may decide against purchasing soy-based products for environmental or health reasons, and coconut has a notoriously strong taste.

“So for us as a brand, [yoghurt] is an obvious one,” said the general manager, along with cheese, cooking products, and ice-cream. Butter is also ‘on the agenda’, Paran revealed.

An ultra-processed backlash?

While there may be sectors within the greater plant-based category that are saturated, “we are so far away from saturation point”, according to Bol Foods founder and CEO Paul Brown.

The ex-Innocent food boss first launched his range of pots, salad jars and soups under the Bol brand in 2015. Two years in, Brown decided to ditch meat and fish from the range, and has since cut out all dairy to become a 100% plant-based brand.

It was also a conscious decision to have no ultra-processed foods in the range, the CEO continued. In saying that, ‘it’s about moderation’: “From my perspective … eating a plant-based burger is better than eating a beef burger. But I do think that over the next few years, as we start to get more data about the nutritional qualities – or otherwise – of some of this highly processed stuff, there could be a bit of a backlash.” Brown conceded there is a market for ultra-processed, ‘but it’s not as healthy’.

Sainsbury’s Hamilton similarly predicted a move away from ultra-processed ‘science’ in the future. “I think there will be roles for both parts,” he said, referring to ultra-processed foods made by scientists, and traditional cooking methods. While highly processed manufacturing is advantageous in terms of cost efficiency and reliability, it can create disconnect between values and food, and specifically, how much consumers are willing to pay for products, he continued.

Whatever the processing method, Bol Foods’ Brown advised entrepreneurs to push boundaries. “There is a paradigm shift happening and, like any good business idea, you’ve got to be ahead of the trend,” said Brown. “[Come] up with consumer insight that no one else has done, innovate, and feel really uncomfortable. If you’re doing something that feels really obvious, it’s probably not going to work.”