Nine-month results 2015/16

Barry Callebaut sales up despite ‘sluggish’ chocolate market

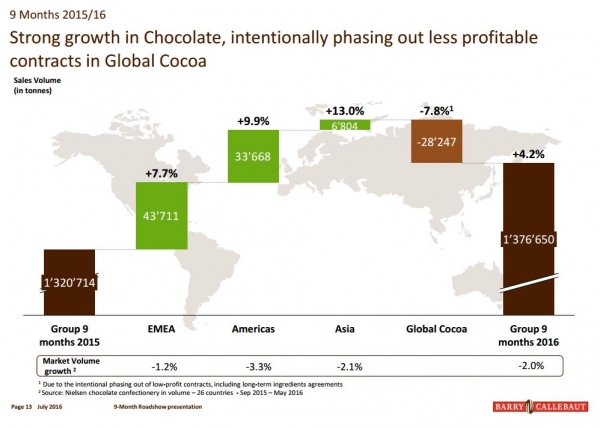

In the first nine months of fiscal year 2015/16 (ended May 31, 2016), the group grew its sales volumes by 4.2% to 1,376,650 metric tons, while its revenues were up 11.4% in local currencies to CHF 5bn ($5.1bn)

This came as the global chocolate confectionery market declined 2% over the same period, according to Nielsen data.

Weak chocolate market

“Our chocolate business performed particularly well, despite still sluggish demand for chocolate confectionery,” said Antoine de Saint-Affrique, CEO of the Barry Callebaut.

Chocolate confectionery volumes in the overall market declined 1.2% in Europe, 3.3% in the Americas and 2.1% in Asia-Pacific over the nine month period, Nielsen data shows.

But Barry Callebaut bucked the trend with 7.7% volume growth in Region EMEA (Europe, Middle East, Africa), 9.9% growth in the Americas and 13% growth in Asia-Pacific.

Phasing out less profitable contracts

De Saint-Affrique said his company was continuing to phase out less profitable contracts in its cocoa business.

This led to a 7.8% sales decline in the firm’s Global Cocoa business – which supplies cocoa ingredients such as butter and powder.

However, all other segments grew. The firm’s largest division 'Food Manufacturers' – which supplies chocolate to firms such as Hershey and Mondelēz - was up 8.3% in volume during the period.

Barry Callebaut’s Gourmet & Specialties businesses, which sells decorations and value-added ingredients mainly to chefs and food service outlets, grew volumes 11.4%.

Cocoa costs and outlook

The company said its positive results were partly due to higher ingredients costs, which it primarily passes on to customers.

Cocoa bean prices were up around 5% during the nine-month period, while world sugar prices were also up, said Barry Callebaut.

De Saint-Affrique added that market conditions “remain challenging in the short-term”.

“In that context, we will continue to reduce sales of cocoa products to third parties by phasing out less profitable cocoa agreements, which is impacting short-term growth,” he said.

The company confirmed its mid-term guidance to have average volume growth of 4.6% over the three-year period 2015/16 to 2017/18 and EBIT above volume growth in local currencies, barring major unforeseen events.