A look at the top product launches in Germany, Europe's 'innovation testing ground'

One of the reasons is down to the fact it's the largest food and drink market in Europe. But it is also due to the incredibly tough competition and price war in the retail sector, Mintel food and drink analyst, Julia Buech, told FoodNavigator.

“[This] fuels innovation, as market players continuously need to bring out fresh concepts to stay relevant and add value to differentiate their offerings in today’s modern world,” she said.

The market research company has recently published a list of the top ten most innovative product launches in Germany in an online blog to highlight this innovation.

One such product is Helga by Evasis Edibles, a low-calorie fizzy soft drink with freshwater microalgae chlorella. Meanwhile Voelkel’s Vegan to Go is a drinkable meal made with fruit and vegetables, quinoa, wheatgrass, spirulina and matcha tea.

“This drink puts its own stamp on two major trends in the world of food and drink: healthy snacking, and the active movement towards more plant-based diets,” write analysts Katya Witham and Julia Buech.

The trend for plant-based protein is represented both by Prolupin’s Made with Luve lupine ice cream or Dr. Oetker’s spicy meat-feast pizza for vegetarians.

Pizzas that specifically make vegetarian claims is still relatively niche in Germany – making up just 3% of launches between 2010 and 2014, say the analysts – but over a third of pizza launches contained no meat.

Meanwhile Slendier organic noodles by D’Lite food are made from the konjac root, an ingredient gaining traction in Germany as it contains no carbohydrates. Low-carb claims more than doubled between 2014 and 2015, say Buech and ….

But innovation isn’t limited to the food or drink but the packaging. Fürstenberg’s Bilger Stümple beer and its retro bottle design that taps into the trend for heritage and craft and the “strikingly plain and puristic” cheese packaging of Leerdammer’s Deli Fresh cut cheese were both praised by the research company.

"In an era of product abundance, brands need to communicate added value to differentiate their products, and packaging plays a crucial part in that process. Successful new products need to feature modern, unique packaging which helps the consumer understand the 'story' behind the finished product. Such stories have to be authentic and engaging, and can for example highlight a brand’s long tradition and evolution over the years, or craft or handmade attributes which continue to gain new importance in today’s industrialised world," said Buech.

Europe's innovation testing ground

Several of the products that feature in Mintel’s top come not from Germany but other European countries – Dutch, Belgian and Austrian companies all feature. Buech

explained this is because many companies use it as a testing ground for their innovative products, with German consumers highly receptive to new culinary trends from around the world.

“Germany is a very attractive market for European companies to step into, offering business opportunities on all fronts. Companies can also use the market as a testbed for innovative products. This offers a strong base for innovation from different markets, and means that the food and drink landscape is becoming increasingly diverse.”

As far as determining which of these products would work well in other regional markets, Buech said manufacturers should look for products that offer “touchpoints.”

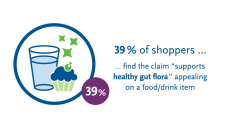

These touchpoints could include benefits in the fields of health and wellness, premiumisation or indulgence. “Important to note is that consumers across Europe show a growing interest in unique offerings which counter the mass appeal of products which have traditionally dominated the market, and are increasingly open to 'niche' concepts,” she added.

!['There are several incorrectly qualified and labelled products [because] the supervisory authorities do not have specific and adequate measures to regulate this kind of behaviour,' said de Castro. © iStock/Kuvona](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/3/0/2/3/3373203-1-eng-GB/MEPs-oppose-plant-based-alternatives-using-meat-terms.jpg)